With most of the world still in the throes of COVID-19, efforts to mitigate its impact are creating unique circumstances in global financial markets. Governments and central banks’ extraordinary financial support has generated high levels of liquidity in the market, giving troubled businesses tremendous scope for emergency funding and restructuring that would likely not otherwise be available to them. Solvency issues, however, are being delayed rather than solved, leaving many to fear a wave of corporate defaults in 2021 is all but inevitable when support from governments and banks finally expires.

The Federal Reserve has committed to keeping interest rates at near-zero levels, and maintaining sovereign and corporate bond-buying programmes, until the economy recovers. Working in tandem with governments, central bank support has maintained liquidity in the market, resulting in record corporate bond issuances by the end of Q2. Bank of America estimates central bank asset purchases have averaged globally about $1.5bn an hour this year. Without this support, it may well be that diminished liquidity would have shut off access to the market and resulted in higher levels of corporate default.

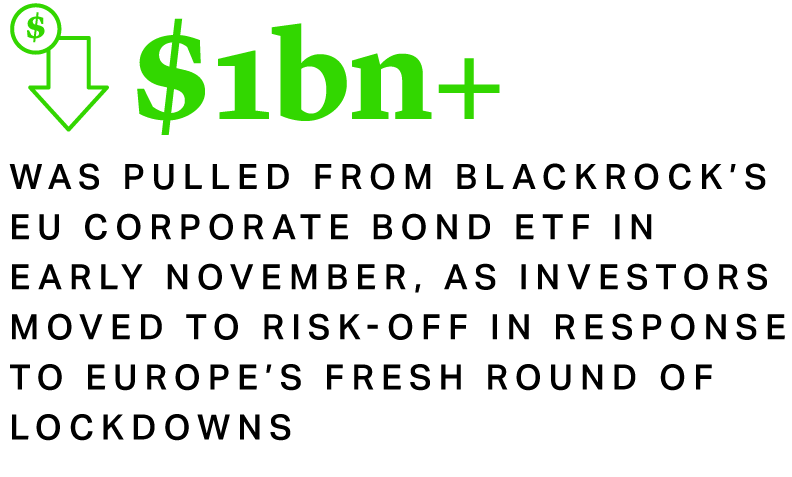

Despite this considerable support from central banks, there are signs investors may be losing confidence across Europe and America.

The US saw a similar mass exodus in late September, when investors pulled $5.4bn{{1}}{{{Investors pull $25.8 billion from U.S. equity funds: BofA

Source: Reuters}}} from the high yield market, amid fears of both the virus and a contested US election.

The Federal Reserve has committed to keeping interest rates at near-zero levels, and maintaining sovereign and corporate bond-buying programmes, until the economy recovers. Working in tandem with governments, central bank support has maintained liquidity in the market, resulting in record corporate bond issuances by the end of Q2. Bank of America estimates central bank asset purchases have averaged globally about $1.5bn an hour this year. Without this support, it may well be that diminished liquidity would have shut off access to the market and resulted in higher levels of corporate default.

Despite this considerable support from central banks, there are signs investors may be losing confidence across Europe and America.

The US saw a similar mass exodus in late September, when investors pulled $5.4bn{{1}}{{{Investors pull $25.8 billion from U.S. equity funds: BofA

Source: Reuters}}} from the high yield market, amid fears of both the virus and a contested US election.

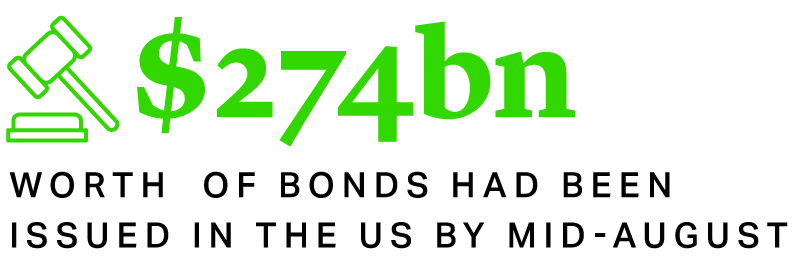

The high-yield, or junk bond, market fluctuated considerably this year. The pandemic closed the European market for two months from late February. By mid-August,$274bn-worth{{2}}{{{Much of America Is Shut Out of The Greatest Borrowing Binge Ever

Source: Bloomberg}}} of bonds had been issued in the US, before late September saw the start of investors pulling back. In Europe, where the high-yield market is less developed, non-investment grade debt issuance had accelerated by the end of the first half of the year.

Central bank interventions have been supportive of the high-yield market. This is particularly the case among cross-over issuers and so-called ‘fallen angels’ in the US, where US Federal Reserve has bought bonds directly from companies like Ford, whose credit ratings have been downgraded during the crisis. Stopping short of this, the European Central Bank has agreed to accept bonds of this kind as collateral. While this has allowed the issuers across the credit spectrum to continue to tap the capital markets, elevated spreads since early 2020 show that investors perceive significant risk among high-yield issuers, specifically in sectors such as retail where default rates have been particularly high.

The high-yield, or junk bond, market fluctuated considerably this year. The pandemic closed the European market for two months from late February. By mid-August,$274bn-worth{{2}}{{{Much of America Is Shut Out of The Greatest Borrowing Binge Ever

Source: Bloomberg}}} of bonds had been issued in the US, before late September saw the start of investors pulling back. In Europe, where the high-yield market is less developed, non-investment grade debt issuance had accelerated by the end of the first half of the year.

Central bank interventions have been supportive of the high-yield market. This is particularly the case among cross-over issuers and so-called ‘fallen angels’ in the US, where US Federal Reserve has bought bonds directly from companies like Ford, whose credit ratings have been downgraded during the crisis. Stopping short of this, the European Central Bank has agreed to accept bonds of this kind as collateral. While this has allowed the issuers across the credit spectrum to continue to tap the capital markets, elevated spreads since early 2020 show that investors perceive significant risk among high-yield issuers, specifically in sectors such as retail where default rates have been particularly high.

With an unprecedented $272bn in dry powder ready to deploy in the direct loans space{{3}}{{{Asset managers in $300bn drive to build private lending funds

Source: Financial Times}}}, alternative asset managers have stepped in to provide much needed liquidity at times of dislocation in the leveraged loan and high-yield bond markets or to borrowers shunned by the traditional bank and capital markets.

These private lenders can deliver significant credit far more quickly than banks – an invaluable fe'at for distressed businesses – but have return expectations typically far higher than those of the institutional bank and bond market. While much of their capital was priced out by cheaper sources of debt prior to 2020, the combination of speed of execution, flexibility and risk appetite of these savvy lenders has enabled them to take full advantage of the opportunities stemming from the COVID-19 outbreak. The growth is only expected to accelerate: in October, HPS Investment Partners raised $9bn for one of the largest ever funds to provide leveraged loans, demonstrating a growing trend of companies turning to private lenders in the current climate.

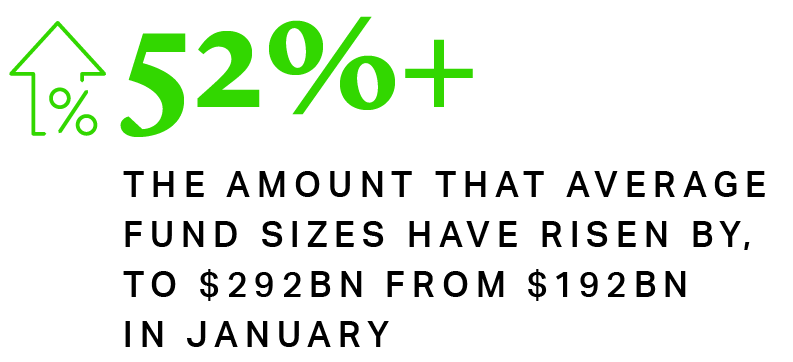

Asset managers are reportedly looking to raise almost $300bn in private lending deals, in a bid to draw investors away from public markets currently pumped with financial stimulus from central governments and banks. According to data from Preqin and the Financial Times in October, asset managers pitched 520 private equity funds to investors in October, compared to 436 at the start of the year and just under 400 in January 2019.

Those seeking to attract investment in the sector argue that the private credit market is not yet saturated and benefits from the tighter restrictions on banks’ ability to finance riskier clients. Asset managers already have $2.6tn of dry powder, according to the Preqin data. The market is also more appealing due to the drop from 11% to 5% return from junk bonds due, once again, to central banks’ support (see above).

These market conditions allow borrowers to patch up short-term liquidity problems. In reality, however, this means distressed companies are taking on high levels of debt to replace revenue lost by the lockdowns, rather than to grow their businesses. Inevitably, this debt may prove difficult to repay, leading to the rise of so-called ‘fallen angels’ and ‘zombie’ companies in the market.

Zombie companies, said to be prevalent in today’s global market, raise the risk of high levels of corporate defaults in the near future. Ratings agency S&P Global predicts Europe’s speculative-grade corporate default rate will more than treble from 2.4% in March 2020 to at least 8.5% by March 2021.

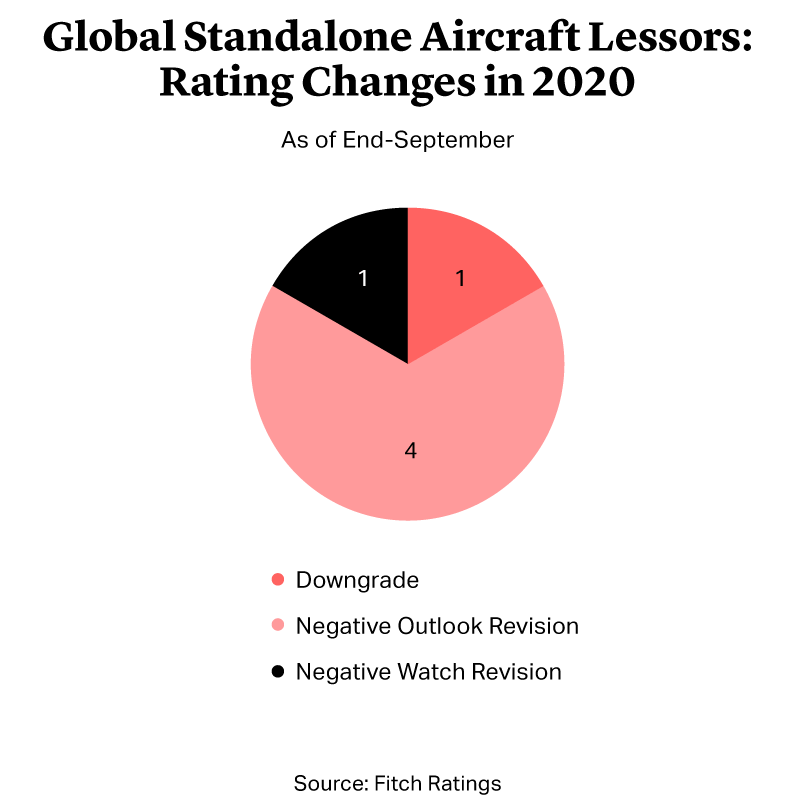

Widespread travel restrictions and flight cancellations caused the number of mainline passenger services to fall by more than 60% from January to April, with demand still far below 2019 levels. In April and May, two-thirds of the global mainline passenger jet fleet was grounded, and a significant proportion may never return. Lessors had, reportedly, received deferral requests from over 80% of airlines. This was followed up with wide scale airline lessee defaults and bankruptcies. By October, there had been around 25 notable airline bankruptcy filings including Virgin Atlantic, Virgin Australia, Nok Air, Smartwings/Czech Airlines, South African Airways and Thai Airlines. South America was among the regions hit particularly hard, with several bankruptcy filings in mid-summer, including Aeromexico, Avianca and LATAM.

Lessors with concentrated customer bases are disadvantaged because their fates are more tied to individual airlines. Of its 48-strong fleet, Avation PLC leased 13 aircraft to Virgin Australia, which entered administration in April. In its recent investor update presentation, Avation reported a 62% fall in total profit after tax year-on-year and an increase of $35mn of impairment losses, $18.9mn of which was recognised in relation to aircraft formerly leased to Virgin Australia. Lessors with a more diversified base may well be able to weather the storm better.

In the medium term, lessors face potential liquidity and even refinancing issues, depending on the impact from deferrals, asset sales, fleet resizing and capex requirements. Aviation lessors’ ability to secure financial accommodation from existing creditors would be pivotal to their survival. Traditionally, aviation commercial banks provided the bulk of funding requirements for lessors, alongside export credit agency support, but there is a growing reliance on capital markets, which would make any restructuring more complicated.

David J. Billington

Partner

London

T: +44 20 7614 2263

dbillington@cgsh.com

V-Card

Polina Lyadnova

Partner

London

T: +44 20 7614 2355

plyadnova@cgsh.com

V-Card

Carlo de Vito Piscicelli

Partner

Milan

T: +39 02 7260 8248

London

T: +44 20 7614 2257

cpiscicelli@cgsh.com

V-Card