In recent years, companies and investors have increasingly been interested in pursuing liquidity and restructuring solutions outside of bankruptcy, avoiding formal proceedings and the costs and risks associated with them.

Liability management transactions are one tool in the restructuring toolkit which we expect to continue to be popular into 2024. These transactions are already having a knock-on effect on how distressed M&A is playing out in comparison with the traditional ways in which lenders and investors have participated in and structured those transactions.

In this article, we discuss how these transactions are changing the game for investors and companies in the distressed debt space and why the market should continue to expect more out-of-court restructuring solutions. We also look at some of the sectors we expect to continue to be relevant in 2024.

Liability Management’s Popularity Leads to Repeat Transactions

As it becomes more common for companies to engage in multiple liability management transactions in order to bolster liquidity during adverse market conditions or a negative business cycle1, companies are increasingly finding it harder to locate unpledged assets to borrow against. In many cases, assets have often already been pledged in previous out-of-court deals. Companies are also being required to accept increasingly restrictive debt documents, as lenders work to close off contractual openings prior liability management transactions have utilized.

If the past is prologue, a meaningful number of the companies that previously agreed out-of-court deals will still one day face the need to file bankruptcy in order to restructure their significant long-term debt obligations. Although some may characterize a post-transaction filing as a “failure”, the resulting in-court proceedings often are streamlined compared to other free-fall situations. For example, in many cases, all of the companies’ material assets have been pledged and the lender base has been consolidated around a group of key secured creditors that provided recent additional capital and has accounted for the risk of a potential future filing. In that way, the bankruptcy provides a critical runway for a company to come up with a solution: either in the form of liquidation or handing over the keys to lenders, for example.

A more aggressive lending market, the increase in liability management solutions, and the presence of sophisticated investors are driving this trend, enabling companies to take advantage of financing outside of bankruptcy, in the hope of turning the corner and obviating the need for a full filing.

Distressed M&A Deals: Then and Now

This increased reliance on out-of-court restructuring, and the resulting debt loads, could bring about a significant shift in how bankruptcies play out over the year ahead – and the investment opportunities associated with them.

U.S. bankruptcies, for example, have traditionally been viewed as an opportunistic play for strategic counterparties or financial investors in distressed debt. Bankruptcies can provide investors with opportunities to successfully cleanse distressed companies’ assets on a going-concern basis. Investors have also historically been able to buy a going-concern business at a discounted price, free and clear of any liens, and/or acquire valuable assets without the company’s associated liabilities or financial debt2.

Distressed M&A Deals: Then and Now

This increased reliance on out-of-court restructuring, and the resulting debt loads, could bring about a significant shift in how bankruptcies play out over the year ahead – and the investment opportunities associated with them.

U.S. bankruptcies, for example, have traditionally been viewed as an opportunistic play for strategic counterparties or financial investors in distressed debt. Bankruptcies can provide investors with opportunities to successfully cleanse distressed companies’ assets on a going-concern basis. Investors have also historically been able to buy a going-concern business at a discounted price, free and clear of any liens, and/or acquire valuable assets without the company’s associated liabilities or financial debt2.

Absent of a sudden free-fall, a distressed company typically would attempt to find buyers for its assets prior to approving a bankruptcy filing, and then file with a stalking horse bidder in tow, with a fully negotiated sale contract already agreed. The stalking horse bid would thereby set a floor price for the company’s assets in a post-filing bidding process. Existing secured lenders – as the parties would first benefit from the sale proceeds – would be approached by the company to ensure they were aligned with the sale process generally and the terms of a stalking horse bid, in order to facilitate a smooth process and because they often provide necessary bridge financing or consented to the use of cash collateral pending completion of the sale.

In many cases, a distressed company’s sale of its business or its assets would cover the existing secured lenders, with value remaining for unsecured creditors. But, more recently, with companies increasingly relying on secured debt to finance their operations prior to seeking bankruptcy protection, it has often become a more difficult hurdle to obtain bids on distressed assets that would clear the secured debt. To the extent sequential refinancings continue to be undertaken by companies out of court in the current market, this trend is likely to continue.

Higher levels of debt and fewer opportunities to extract value mean that companies are increasingly struggling to find buyers. Potential strategic or financial investors are either not interested in the company at all, or they are simply not willing to pay a high enough price to either fully repay or receive consent from existing secured debtors. The nature of the business can also have an impact. Recent bankrupt startup companies born out of special purpose acquisition companies (SPACs), for example, have required significant new money investment to achieve viability, making the value proposition less attractive to investors even at near de minimis cash prices for the business assets.

As a result, we are now seeing an increasing trend whereby companies file for bankruptcy and propose a sale process without a stalking horse bidder and without any clear expectation a buyer ultimately will surface, as pre-filing marketing of the assets was unsuccessful. In these cases, assuming no successful bid, companies will most often file a bankruptcy plan in which their assets are turned over to the secured lenders and unsecured creditors are left empty-handed.

As a result of this trend, restructurings often are less about value-creating opportunities and more about loss mitigation for investors. At the same time, companies will often need debtor-in-possession financing to keep afloat during the bankruptcy process. This will usually need to come from existing lenders, who will need to be confident that the business will be sold in order to provide post-petition financing. This can create a difficult dynamic for lenders, who need to decide whether to fund into a bankruptcy that may ultimately result in them taking a loss on their investments. Secured lenders have attempted to have these cases administered quickly, where the Office of the U.S. Trustee, unsecured creditor committees or even the court may push the lender to support and finance a longer sale process in the hope of identifying a better alternative restructuring path.

Out-of-Court Solutions

As mentioned above, companies are increasingly looking to find alternative avenues to bankruptcy – whether through extending maturities or through financing. There is a growing perception that bankruptcies can be a longer and more expensive procedure, while their public nature brings the potential for outside forces to meddle with the restructuring.

Although there is a continuing trend for companies to seek solutions outside of court, there are instances where effectuating a restructuring in this way will be difficult. This could be, for example, where debt is too widely held to meaningfully negotiate with the entire group, or where there are minority “hold-out” lenders who prevent necessary modifications of existing documents. In other cases, it could make sense for companies to simply hand over the keys to existing secured lenders, which we may see happen outside of formal bankruptcy proceedings. Not all lenders are interested in that outcome though, which has led to the rise of a new variant of “zombie” company – one that can fund operations but cannot effectively service its debt and continues to exist because its lenders are unwilling to foreclose on their collateral.

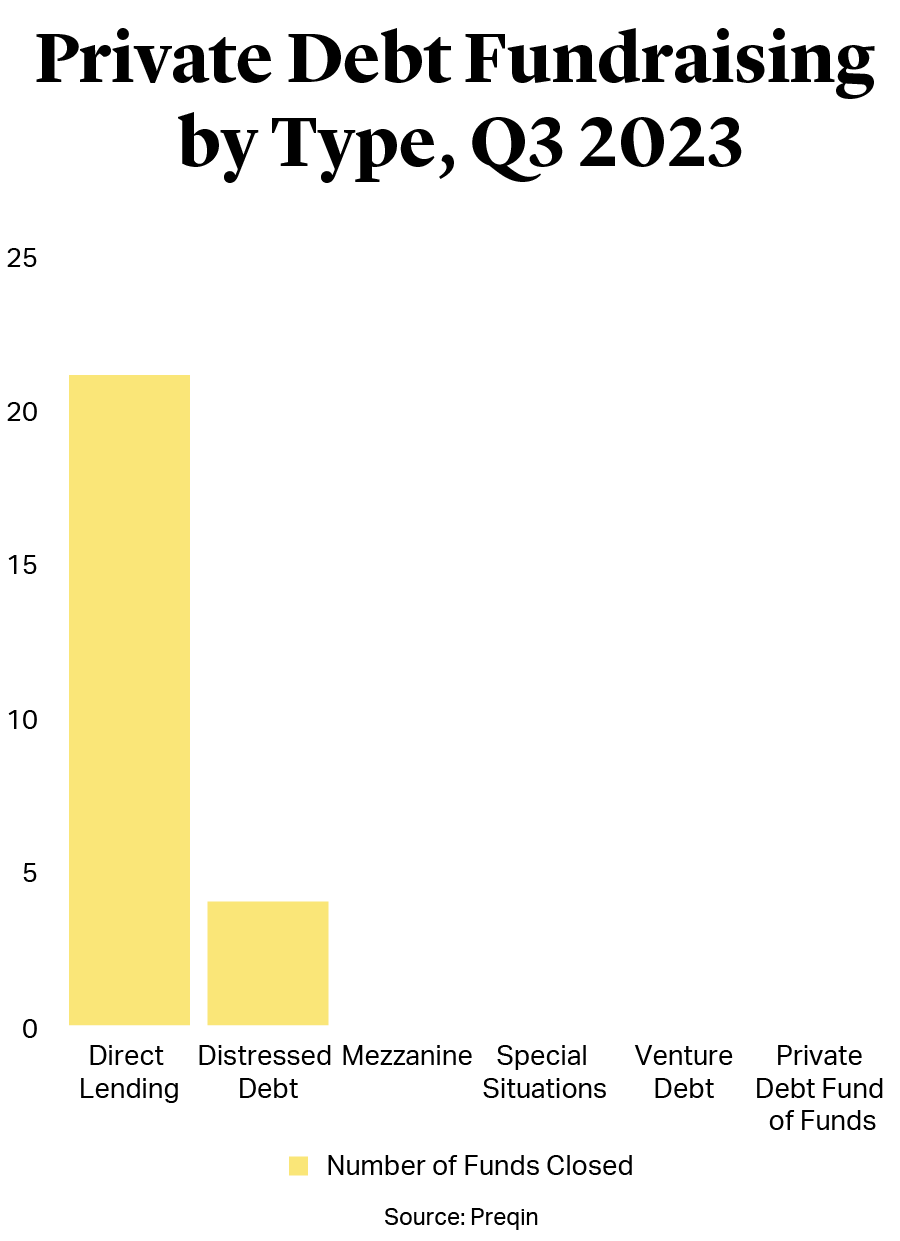

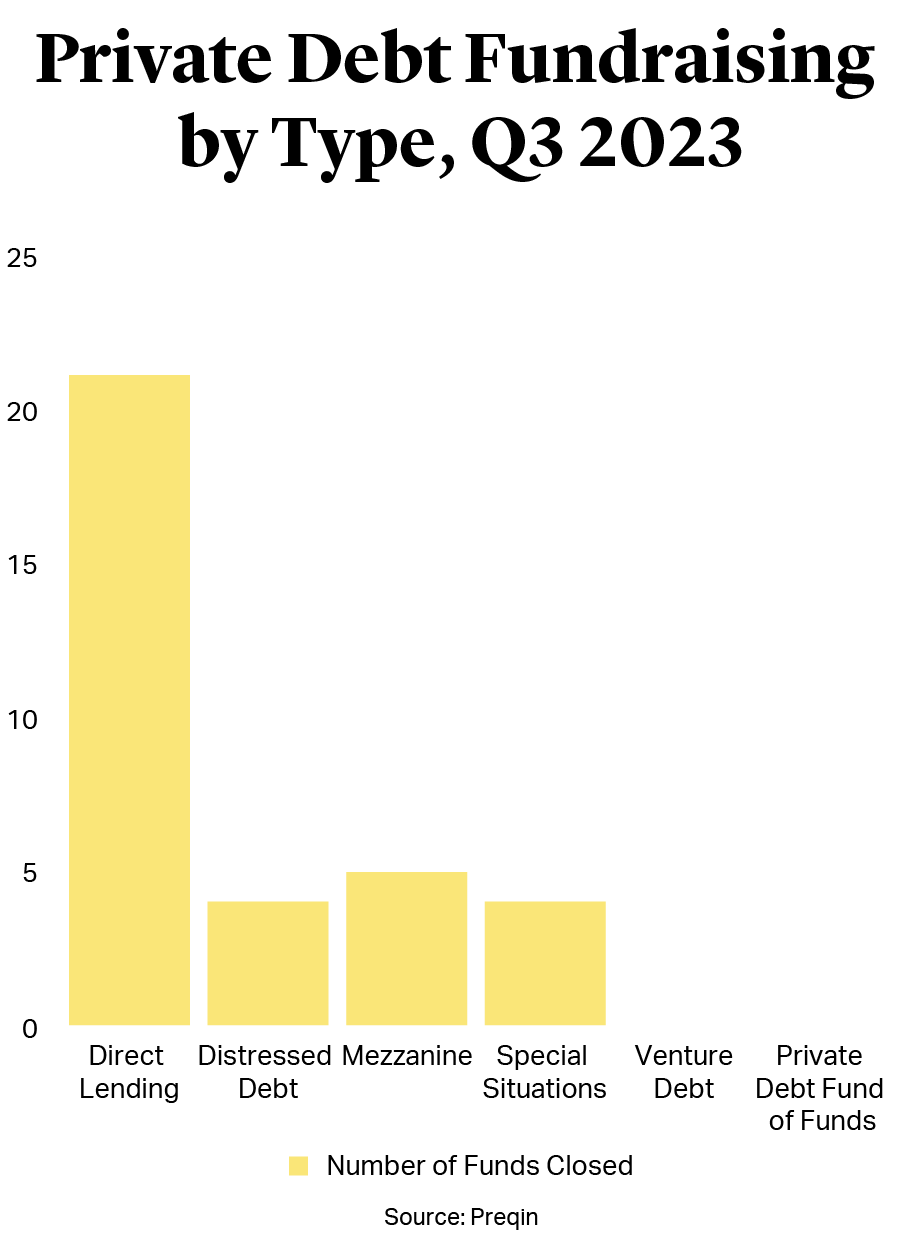

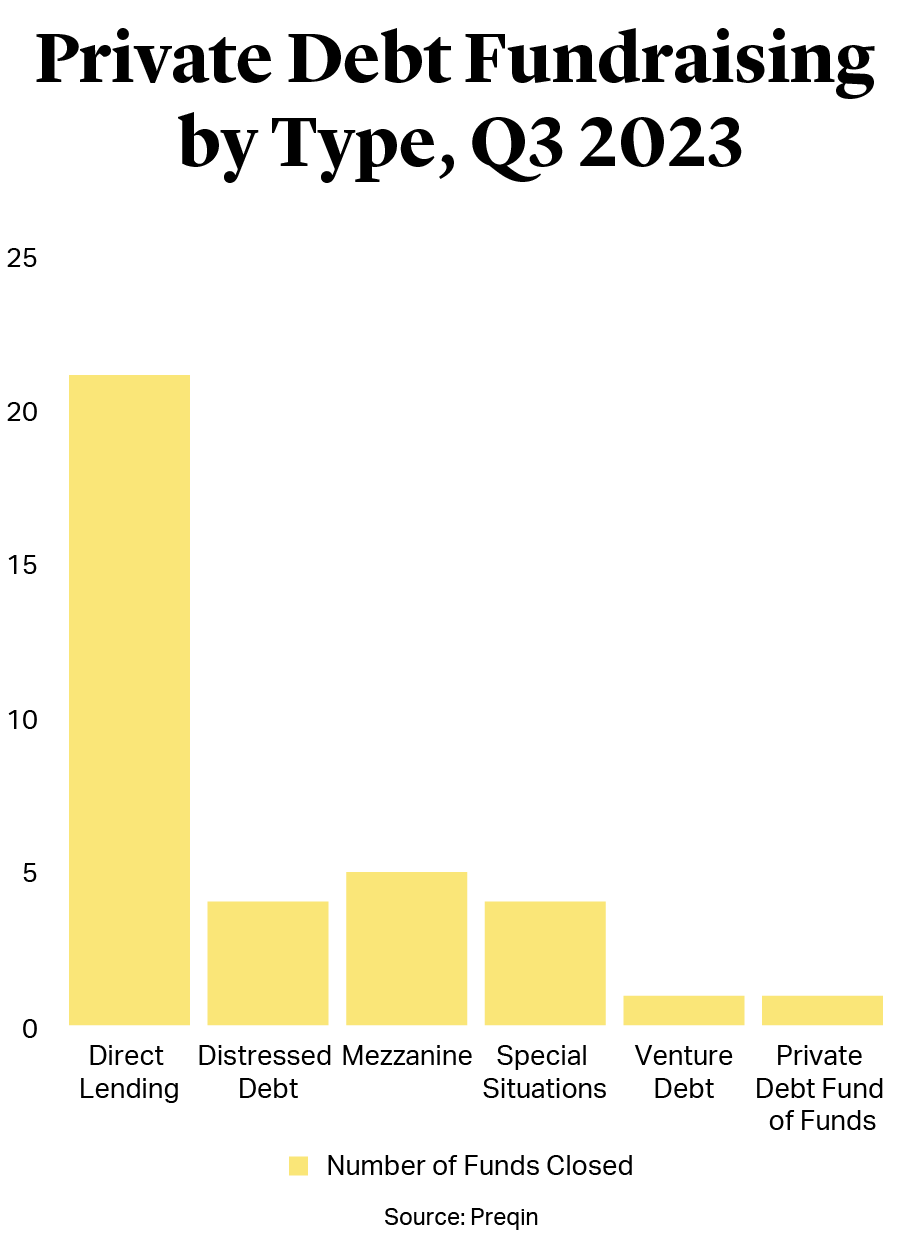

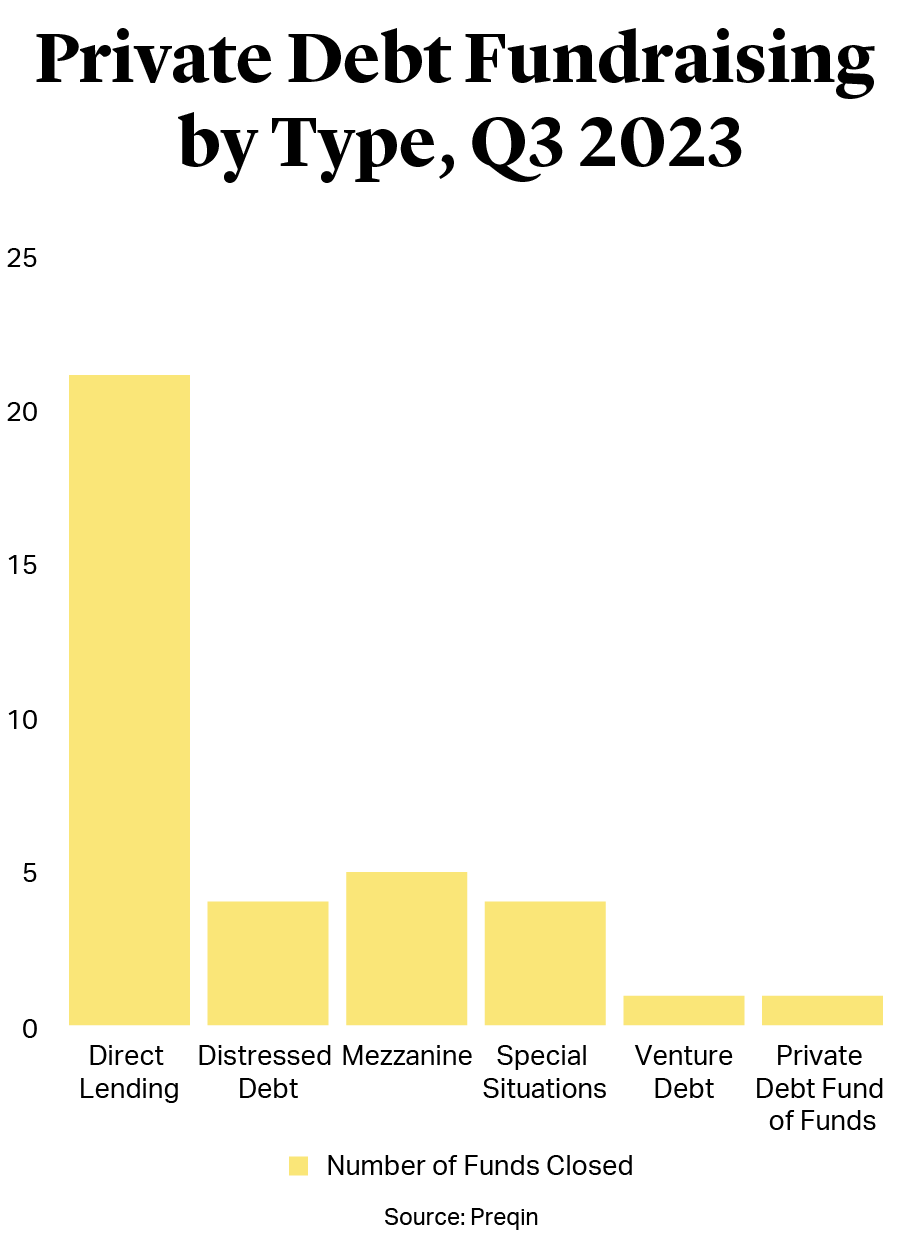

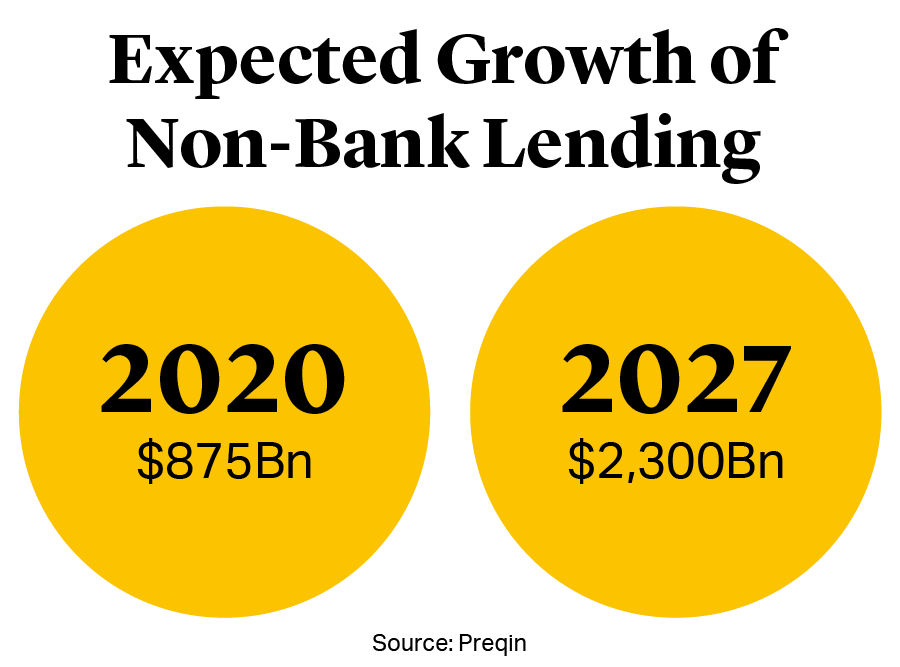

At bottom, we expect existing attitudes toward in-court proceedings and macroeconomic forces will continue to drive creative out-of-court solutions over the year ahead, helped along by the availability of private credit from sophisticated investors, which has been growing steadily since the financial crisis. This type of funding is expected to continue to reach $2.3tn in 20273, with the strongest growth expected in North America. Borrowers are seeking more creative sources of financing from strategic partners in the high interest rate environment. We expect to continue to see non-bank direct lending – financing that is directly negotiated between a lender (usually an alternative asset management firm) and a company – playing an important role in the distressed debt space in 2024. Already, direct lending represents the largest category in private credit, at 44% of assets under management4.

Although there is a continuing trend for companies to seek solutions outside of court, there are instances where effectuating a restructuring in this way will be difficult. This could be, for example, where debt is too widely held to meaningfully negotiate with the entire group, or where there are minority “hold-out” lenders who prevent necessary modifications of existing documents. In other cases, it could make sense for companies to simply hand over the keys to existing secured lenders, which we may see happen outside of formal bankruptcy proceedings. Not all lenders are interested in that outcome though, which has led to the rise of a new variant of “zombie” company – one that can fund operations but cannot effectively service its debt and continues to exist because its lenders are unwilling to foreclose on their collateral.

At bottom, we expect existing attitudes toward in-court proceedings and macroeconomic forces will continue to drive creative out-of-court solutions over the year ahead, helped along by the availability of private credit from sophisticated investors, which has been growing steadily since the financial crisis. This type of funding is expected to continue to reach $2.3tn in 20273, with the strongest growth expected in North America. Borrowers are seeking more creative sources of financing from strategic partners in the high interest rate environment. We expect to continue to see non-bank direct lending – financing that is directly negotiated between a lender (usually an alternative asset management firm) and a company – playing an important role in the distressed debt space in 2024. Already, direct lending represents the largest category in private credit, at 44% of assets under management4.

Specific Sectors

Renewable energy and green initiatives will continue to make headlines in restructuring next year while macroeconomic challenges weigh on market dynamics.

In the U.S., car manufacturers have struggled with sales of electric vehicles, and in some cases have incurred losses in their electric vehicle businesses. While large car manufacturers might be able to offset these losses, electric vehicle startups – along with companies that are part of a whole supply chain – have faced cashflow challenges amid slowing demand. These issues are unlikely to go away over the next year.

Sluggish demand amid the wider macroeconomic environment is also affecting other green sectors, such as renewable energy companies. Last year saw a number of solar companies being downgraded by Wall Street analysts as rising rates made it more expensive for potential customers to borrow to pay for panels5. Operational issues faced by biomass company Enviva – billed as a cleaner alternative to fossil fuels – have also shed light on challenges faced by the sector6. Green energy companies will continue to be in the spotlight over the year ahead.

Specific Sectors

Renewable energy and green initiatives will continue to make headlines in restructuring next year while macroeconomic challenges weigh on market dynamics.

In the U.S., car manufacturers have struggled with sales of electric vehicles, and in some cases have incurred losses in their electric vehicle businesses. While large car manufacturers might be able to offset these losses, electric vehicle startups – along with companies that are part of a whole supply chain – have faced cashflow challenges amid slowing demand. These issues are unlikely to go away over the next year.

Sluggish demand amid the wider macroeconomic environment is also affecting other green sectors, such as renewable energy companies. Last year saw a number of solar companies being downgraded by Wall Street analysts as rising rates made it more expensive for potential customers to borrow to pay for panels5. Operational issues faced by biomass company Enviva – billed as a cleaner alternative to fossil fuels – have also shed light on challenges faced by the sector6. Green energy companies will continue to be in the spotlight over the year ahead.

Meanwhile, commercial real estate distress in the U.S. has increased, in part impacted by the continuation of remote working that came into place during the COVID-19 pandemic. U.S. office vacancies in 2023 were lower compared with pre-pandemic levels7 (in September, for example, return-to-office rates totaled 50.1% of their pre-pandemic levels in New York City8).

Distress in the healthcare sector has also increased, with companies suffering from operational challenges and the loss of contracts after the pandemic forcing many non-emergency healthcare centers to scale back or close. Healthcare organizations are also facing a squeeze on their margins amid an inflationary environment which has driven up the cost of goods and led more consumers to defer non-essential care9.

U.S. restructurings are changing. Whereas a decade ago, a distressed company would look to Chapter 11 and the negotiated deals associated with bankruptcy, today it is out-of-court solutions that are becoming more sought-after. Considering the higher interest rate environment, continuing macroeconomic pressures, and changing sector trends, creative out-of-court deals will continue to be relevant in 2024.

Meanwhile, commercial real estate distress in the U.S. has increased, in part impacted by the continuation of remote working that came into place during the COVID-19 pandemic. U.S. office vacancies in 2023 were lower compared with pre-pandemic levels7 (in September, for example, return-to-office rates totaled 50.1% of their pre-pandemic levels in New York City8).

Distress in the healthcare sector has also increased, with companies suffering from operational challenges and the loss of contracts after the pandemic forcing many non-emergency healthcare centers to scale back or close. Healthcare organizations are also facing a squeeze on their margins amid an inflationary environment which has driven up the cost of goods and led more consumers to defer non-essential care9.

U.S. restructurings are changing. Whereas a decade ago, a distressed company would look to Chapter 11 and the negotiated deals associated with bankruptcy, today it is out-of-court solutions that are becoming more sought-after. Considering the higher interest rate environment, continuing macroeconomic pressures, and changing sector trends, creative out-of-court deals will continue to be relevant in 2024.