The distressed debt landscape is shaped by various risks that may not be immediately evident. Of course, geopolitical shifts will be just as relevant for emerging market companies as the impact of regulation will be on businesses in the U.S. However, examining less obvious risks within the credit markets, beyond the headlines, can equip companies to anticipate future challenges. This article delves into the “stories behind the stories,” shedding light on these nuanced risks, and presents our 2024 projections based on observations from the start of the year.

Sector Pinch Points

The real estate market, including commercial real estate and real estate development, and the healthcare industry will continue to face challenges this year. Last year, we detailed the reasons for disruptions in these sectors1.

On the healthcare side, 2024 will see continued litigation as pharmaceutical companies push back against the Biden Administration’s program for lowering what Medicare pays for costly drugs2. Market participants are increasingly focused on the downward pressure these measures are putting on the healthcare sector.

Tightening financial conditions coupled with increased teleworking and e-commerce will continue to see a negative impact on commercial real estate3. Perhaps one of the most visible jurisdictions where the real estate developers’ market has generated a significant activity in the restructuring space is China, and we do not expect this crisis to fade anytime soon. A large wave of defaults began in the second half of 2021. In June 2021, out of 72 offshore high-yield bond-issuing developers, four were in default of their bonds. Since then, another 53 developers have defaulted, including seven in 20234.

Sector Pinch Points

The real estate market, including commercial real estate and real estate development, and the healthcare industry will continue to face challenges this year. Last year, we detailed the reasons for disruptions in these sectors1.

On the healthcare side, 2024 will see continued litigation as pharmaceutical companies push back against the Biden Administration’s program for lowering what Medicare pays for costly drugs2. Market participants are increasingly focused on the downward pressure these measures are putting on the healthcare sector.

Tightening financial conditions coupled with increased teleworking and e-commerce will continue to see a negative impact on commercial real estate3. Perhaps one of the most visible jurisdictions where the real estate developers’ market has generated a significant activity in the restructuring space is China, and we do not expect this crisis to fade anytime soon. A large wave of defaults began in the second half of 2021. In June 2021, out of 72 offshore high-yield bond-issuing developers, four were in default of their bonds. Since then, another 53 developers have defaulted, including seven in 20234.

Some of these issuers had already restructured and subsequently defaulted. Many developers had attempted to extend maturities and buy time to wait for a recovery that never came. This appears to be a never-ending saga, with ongoing cases featuring billions of dollars in debt.

One recent example is that of Chinese property giant China Evergrande Group, which received a liquidation order from a Hong Kong court on January 295. Hong Kong High Court Judge Linda Chan ordered China Evergrande Group to be wound up, leaving to the liquidators the work of providing creditors with recovery. This is just one prominent example of China’s boom-to-bust story of property development, with the company amassing more than $300bn of liabilities.

Even the Middle Eastern market, so far relatively resistant to market pressures, may well experience restructurings in the real estate and construction sectors. The construction sector is particularly vulnerable to distress as it is notoriously capital-intensive.

The market has started to feel the pressure of higher interest rates and lower investment in the area, due to the higher risks associated with the sector. We expect that bigger developers will be better supported, as they can naturally hedge themselves with projects near completion as they seek the funding to launch new ones. It is smaller developers and their suppliers, however, who will feel the heat to a greater extent.

Some of these issuers had already restructured and subsequently defaulted. Many developers had attempted to extend maturities and buy time to wait for a recovery that never came. This appears to be a never-ending saga, with ongoing cases featuring billions of dollars in debt.

One recent example is that of Chinese property giant China Evergrande Group, which received a liquidation order from a Hong Kong court on January 295. Hong Kong High Court Judge Linda Chan ordered China Evergrande Group to be wound up, leaving to the liquidators the work of providing creditors with recovery. This is just one prominent example of China’s boom-to-bust story of property development, with the company amassing more than $300bn of liabilities.

Even the Middle Eastern market, so far relatively resistant to market pressures, may well experience restructurings in the real estate and construction sectors. The construction sector is particularly vulnerable to distress as it is notoriously capital-intensive.

The market has started to feel the pressure of higher interest rates and lower investment in the area, due to the higher risks associated with the sector. We expect that bigger developers will be better supported, as they can naturally hedge themselves with projects near completion as they seek the funding to launch new ones. It is smaller developers and their suppliers, however, who will feel the heat to a greater extent.

Continued Geopolitical Impacts

The impact of recent conflicts on commodity prices and their effects on certain sectors and geographies have been well-documented6. For example, oil prices briefly rose above $80 a barrel for the first time in 2024 following U.S. and UK military strikes in Yemen7.

However, geopolitics can also have a more nuanced effect on specific sectors, and market participants should look beyond headlines that simply address their impact on commodity prices.

Transportation Routes

The U.S. and the UK have carried out military strikes against Houthi rebels in Yemen, in response to shipping attacks by the militias in the Red Sea8. This latest development is having a knock-on effect on transportation routes, with hundreds of cargo ships being rerouted to avoid the attacks.

Activity from the rebels has exposed the international trade sector to a number of challenges, including increased shipping time and fuel costs along one of the main trade links between Asia, the Middle East, and Europe. An estimated 10% of world trade by volume utilizes this route9.

Shipping companies reported millions in costs as a result of diverting vessels in the Red Sea due to the militant attacks. For example, Danish oil tanker group TORM said it had decided to pause all transits through the southern Red Sea for now. Meanwhile, Hong Kong-headquartered container group OOCL said it instructed its vessels to either divert their route away from the Red Sea or suspend sailing. It also stopped accepting cargo to and from Israel until further notice. Danish shipping group Maersk said it expected the Red Sea-related disruption to global shipping would likely last at least a few months10. Diversions in transportation routes will likely raise shipping costs. The businesses most at risk may include car manufacturers and consumer goods retailers, which rely on a just-in-time model and are thus significantly affected by sudden and severe transportation delays.

Shifts in the market created by these geopolitical tensions could impact the shipping industry and their users more broadly in the years to come.

U.S. Political Risks

Political risk is always key in the emerging market space given how the markets are intrinsically involved with governments and global politics, as well as their susceptibility to geopolitical trends.

The 2024 U.S. elections are scheduled to be held in November and historically we have seen that the political outcomes in the country have invariably influenced emerging markets. The potential for change to major political stances in the U.S. is one factor, but the impact of a new administration could bring wider geopolitical implications, as well as affect the credit market given today’s intricately connected markets.

Transportation Routes

The U.S. and the UK have carried out military strikes against Houthi rebels in Yemen, in response to shipping attacks by the militias in the Red Sea8. This latest development is having a knock-on effect on transportation routes, with hundreds of cargo ships being rerouted to avoid the attacks.

Activity from the rebels has exposed the international trade sector to a number of challenges, including increased shipping time and fuel costs along one of the main trade links between Asia, the Middle East, and Europe. An estimated 10% of world trade by volume utilizes this route9.

Shipping companies reported millions in costs as a result of diverting vessels in the Red Sea due to the militant attacks. For example, Danish oil tanker group TORM said it had decided to pause all transits through the southern Red Sea for now. Meanwhile, Hong Kong-headquartered container group OOCL said it instructed its vessels to either divert their route away from the Red Sea or suspend sailing. It also stopped accepting cargo to and from Israel until further notice. Danish shipping group Maersk said it expected the Red Sea-related disruption to global shipping would likely last at least a few months10. Diversions in transportation routes will likely raise shipping costs. The businesses most at risk may include car manufacturers and consumer goods retailers, which rely on a just-in-time model and are thus significantly affected by sudden and severe transportation delays.

Shifts in the market created by these geopolitical tensions could impact the shipping industry and their users more broadly in the years to come.

U.S. Political Risks

Political risk is always key in the emerging market space given how the markets are intrinsically involved with governments and global politics, as well as their susceptibility to geopolitical trends.

The 2024 U.S. elections are scheduled to be held in November and historically we have seen that the political outcomes in the country have invariably influenced emerging markets. The potential for change to major political stances in the U.S. is one factor, but the impact of a new administration could bring wider geopolitical implications, as well as affect the credit market given today’s intricately connected markets.

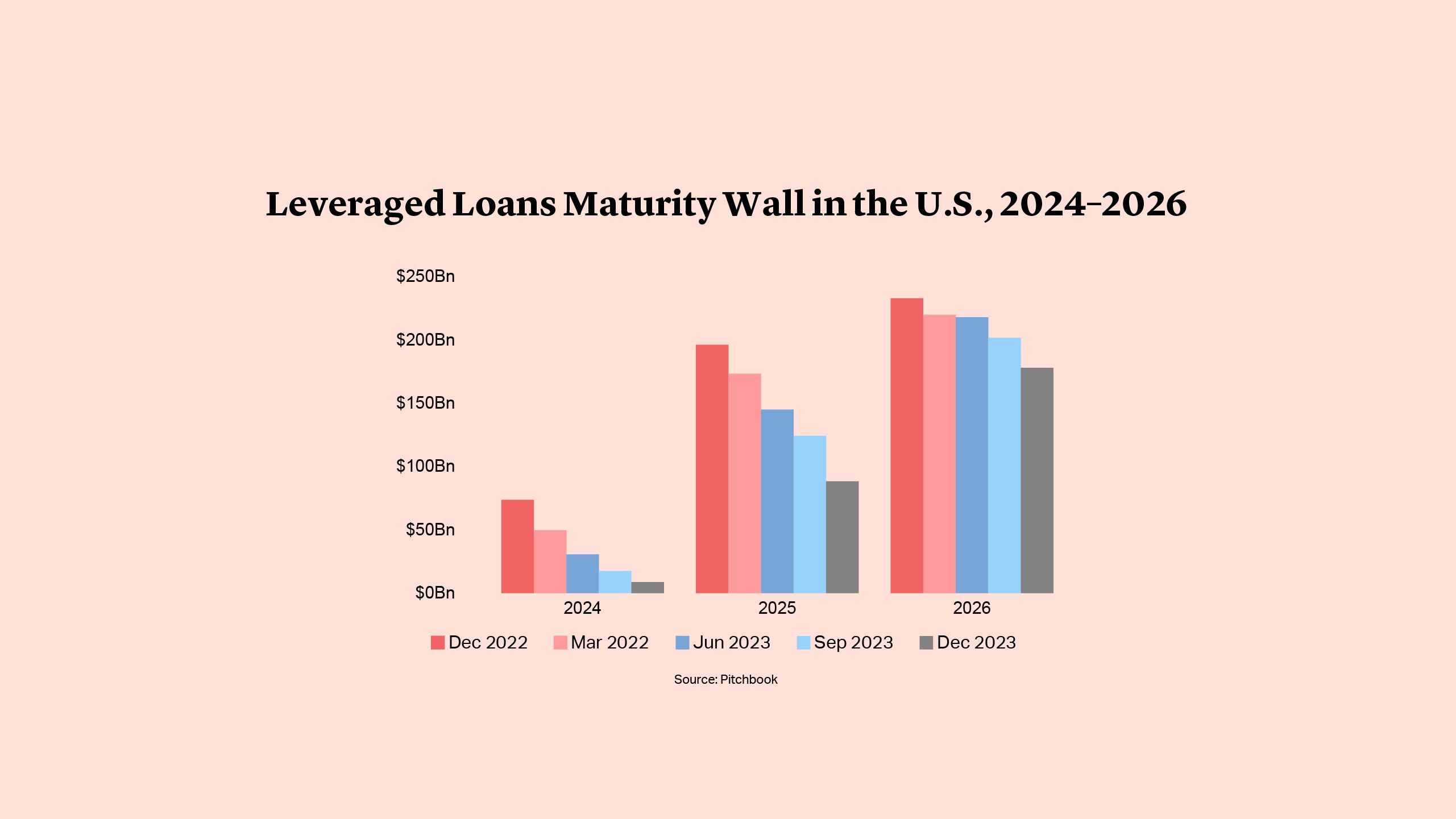

Facing the 2025 Maturity Wall

We expect a continued increase in liability management exercises – or even holistic restructurings – in anticipation of a large maturity wall faced by a number of issuers across both developed and emerging markets.

According to a recent study of the U.S. leveraged loan market, as of December 15, 2023, $89bn in loans will come due in 2025, compared with $9.3bn maturing in 2024. According to the study, more than half (51%) of the 2025 maturity wall is from riskier credits – issuers with a B-rating or lower11.

We have already seen some early indications of this in 2023, when a number of companies engaged in liability management exercises and raised refinancing (inevitably at significantly higher rates and less commercially favorable terms) to address the 2024 (and in some cases 2025) maturities.

Facing the 2025 Maturity Wall

We expect a continued increase in liability management exercises – or even holistic restructurings – in anticipation of a large maturity wall faced by a number of issuers across both developed and emerging markets.

According to a recent study of the U.S. leveraged loan market, as of December 15, 2023, $89bn in loans will come due in 2025, compared with $9.3bn maturing in 2024. According to the study, more than half (51%) of the 2025 maturity wall is from riskier credits – issuers with a B-rating or lower11.

We have already seen some early indications of this in 2023, when a number of companies engaged in liability management exercises and raised refinancing (inevitably at significantly higher rates and less commercially favorable terms) to address the 2024 (and in some cases 2025) maturities.

Adjusting Expectations and Embracing Flexibility in 2024

From a thematic perspective, one key lesson from 2023 is for investors to be more flexible in their expectations. Many investors last year were waiting for a bottoming out of the market, which never materialized. Instead, investors should be prepared to roll with the market in any direction to avoid being unprepared for a quick recovery.

There were opportunities for significant profits to be made in 2023 when the markets recovered that weren’t taken advantage of, as some investors waited for a deeper bottom of the curve before they were prepared to deploy capital. This year could provide more opportunities for more nimble companies and investors.

Adjusting Expectations and Embracing Flexibility in 2024

From a thematic perspective, one key lesson from 2023 is for investors to be more flexible in their expectations. Many investors last year were waiting for a bottoming out of the market, which never materialized. Instead, investors should be prepared to roll with the market in any direction to avoid being unprepared for a quick recovery.

There were opportunities for significant profits to be made in 2023 when the markets recovered that weren’t taken advantage of, as some investors waited for a deeper bottom of the curve before they were prepared to deploy capital. This year could provide more opportunities for more nimble companies and investors.