Recent Chapter 11 bankruptcies of crypto firms including FTX and BlockFi, as well as Celsius Network and Voyager, raise a number of questions that will set the scene for future insolvencies. As the crypto winter deepens, these proceedings also have meaning for jurisdictional disputes between Emerging Market (EM) nations and the U.S. in the context of insolvency. In this article, we provide the background to the cases and then discuss the key questions in these proceedings.

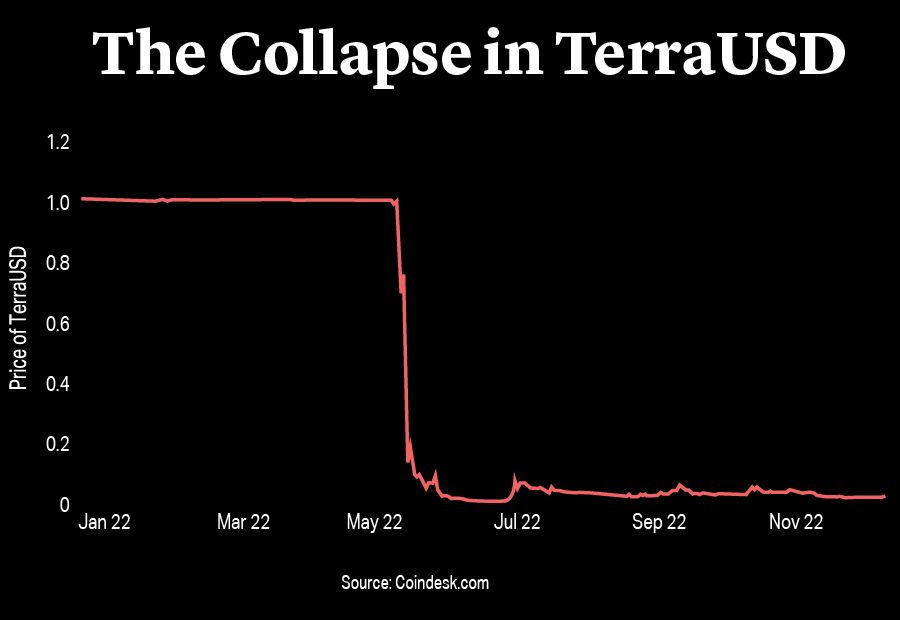

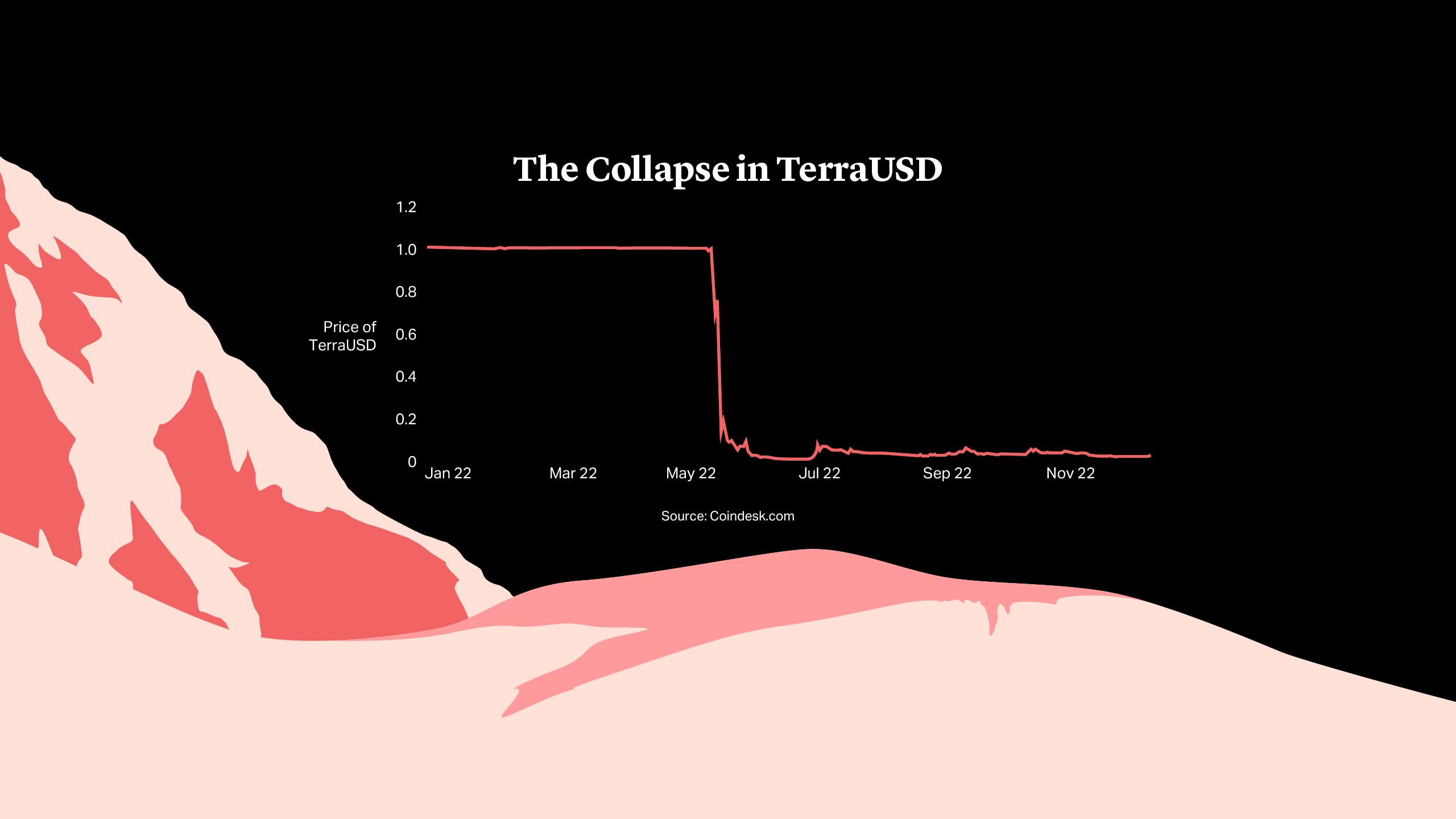

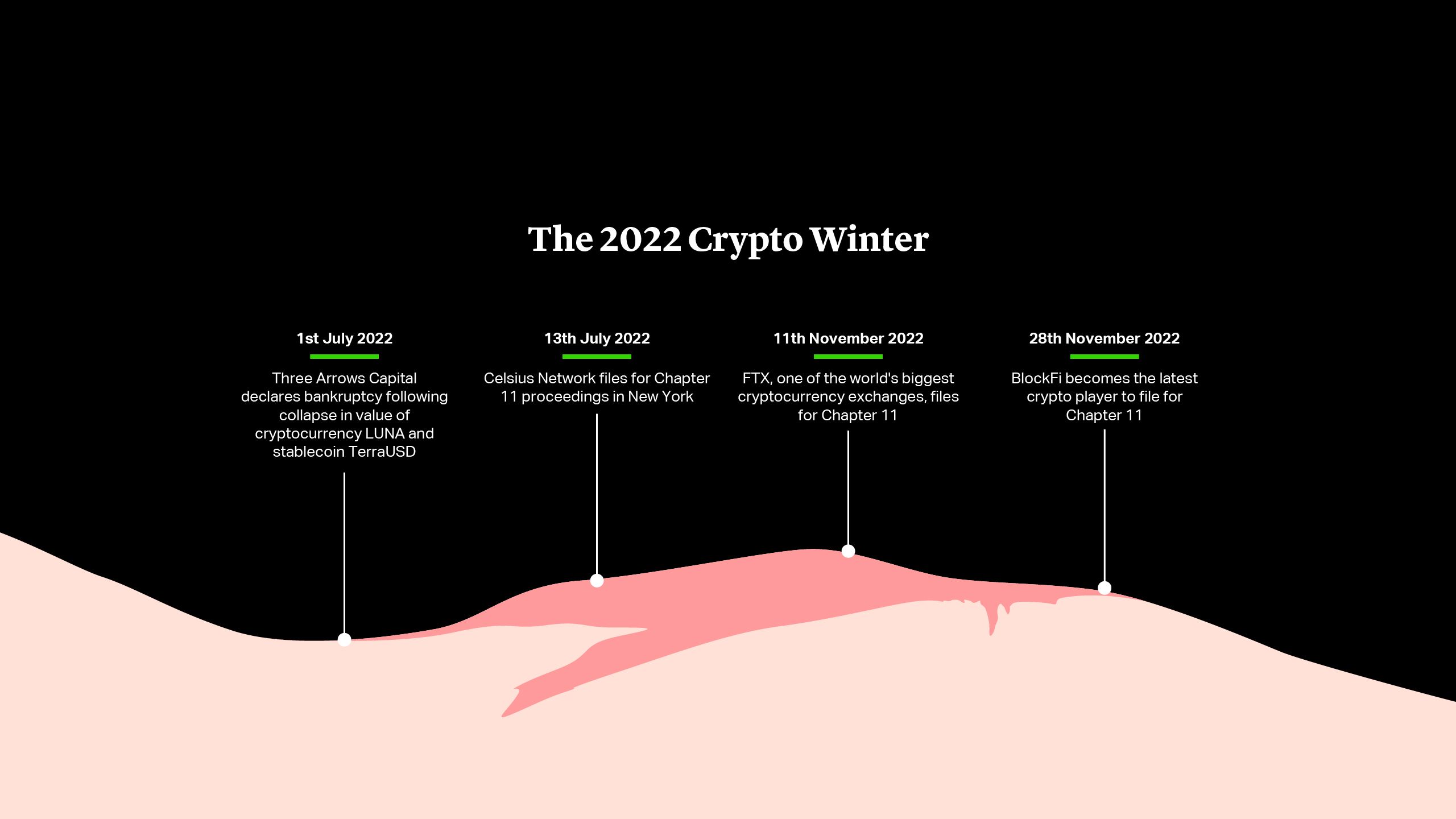

In May 2022, market movements and other factors led to a run-on-the-bank at Terra. As investors tried to redeem their TerraUSD for LUNA – the latter of which was meant to stabilize the former – prices of both plummeted, wiping out the market capitalization of the digital assets.

This had knock-on effects in the entire crypto market. As a result of the implosion, hedge fund Three Arrows Capital was ordered into liquidation by a British Virgin Islands court, and filed for Chapter 15 proceedings in the U.S. The hedge fund had defaulted on loans to a variety of counterparties, including Voyager, a crypto-brokerage firm that had taken in customer deposits and lent them to a number of borrowers including Three Arrows. The default of Three Arrows and general market downturn caused Voyager to put a halt on customer withdrawals and ultimately file for Chapter 11 proceedings.

Shortly after, Celsius Network (which had already been experiencing distress) also filed for Chapter 11 proceedings in New York. According to its court documents, Celsius’ distress was not directly linked to the default of Three Arrows or Voyager, or even the implosion of TerraUSD. Instead, these proceedings were a result of market participants being spooked by the decline in the market more generally. Celsius’ main business was based on customers transferring digital assets to the company and Celsius then lending those assets to third parties. Celsius paused withdrawals on its platform on June 12, 2022, and subsequently filed for bankruptcy in July.

In November, a portion of the Bahamas-based FTX Group filed for Chapter 11 proceedings in Delaware. Prior to the bankruptcy, CoinDesk reported a leak of a balance sheet related to the Alameda Research business showing that much of the $14.6bn of assets held by the business as of June 30 was the FTT token issued by FTX 1. Another crypto exchange, Binance, on November 6 announced plans to “liquidate any remaining FTT on our books” citing “recent revelations”2. A few days later, Binance abandoned a proposed distressed acquisition of FTX following due diligence into its operations and amid “news reports regarding mishandled customer funds and alleged U.S. agency investigations” according to a series of Tweets3.

On 11 November, 2022, the petition date, approximately $372mn of digital assets were stolen in an alleged hack and, separately, approximately $300mn of FTX Group’s FTT token was allegedly minted (the process by which tokens are created) without authorization. The declaration in support of the Chapter 11 proceedings shows that only $740mn of digital assets were located and secured, a fraction of the digital assets they hoped to recover, according to the First Day declaration4.

John J. Ray III, who oversaw Enron’s restructuring, replaced founder Samuel Bankman-Fried as CEO. “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here,” Ray stated in a declaration in support of the Chapter 11 proceedings5. On the evening of December 12, 2022, Bankman-Fried was arrested by Bahamian authorities following the U.S. Attorney for the Southern District of New York filing a sealed indictment that was shared with the Bahamian authorities. Bankman-Fried’s companies have reportedly extended loans to executives, according to FTX’s bankruptcy filings, with Alameda Research loaning $1bn to Bankman-Fried himself, $543mn to Head of Engineering, Nishad Singh, and $55mn to Ryan Salame, Co-Chief Executive of Bahamas-based FTX Digital Markets6. FTX also made loans to the digital asset lender BlockFi, which has subsequently declared bankruptcy, in order to help stabilize the business following the collapse of its counterparty, Three Arrows Capital.

Alongside the Chapter 11 proceedings in Delaware, a concurrent Chapter 15 case was filed in New York by Bahamian joint provisional liquidators for FTX Digital Markets , which is an entity regulated under the digital regulatory regime of the Bahamas. This case was subsequently transferred to Delaware. On November 10, the Securities Commission of the Bahamas suspended FTX Digital Markets' license to conduct business and froze its assets, with a provisional liquidator appointed on the same day, according to the First Day Petition.

Following the losses BlockFi suffered from the collapse of Three Arrows Capital, BlockFi obtained a loan commitment from the FTX US business, which agreed to loan up to $400mn notional amount of digital assets to BlockFi7. As of November 28, 2022, the FTX US business had made loans under the commitment valued at $275mn according to a declaration in support of the Chapter 11 proceedings.

BlockFi filed for Chapter 11 protection on Nov. 29 in New Jersey, with the First Day Declaration saying the company was “faced with a severe liquidity crunch due to the unprecedented, expedited collapse” of FTX and affiliated companies and citing FTX as a “major cause” of the filing. The petition shows the company owes approximately $275mn in USD stablecoins to FTX and $30mn to the SEC8.

Terra(Luna) and TerraUSD

In May 2022, market movements and other factors led to a run-on-the-bank at Terra. As investors tried to redeem their TerraUSD for LUNA – the latter of which was meant to stabilize the former – prices of both plummeted, wiping out the market capitalization of the digital assets.

This had knock-on effects in the entire crypto market. As a result of the implosion, hedge fund Three Arrows Capital was ordered into liquidation by a British Virgin Islands court, and filed for Chapter 15 proceedings in the U.S. The hedge fund had defaulted on loans to a variety of counterparties, including Voyager, a crypto-brokerage firm that had taken in customer deposits and lent them to a number of borrowers including Three Arrows. The default of Three Arrows and general market downturn caused Voyager to put a halt on customer withdrawals and ultimately file for Chapter 11 proceedings.

Celsius Network

Shortly after, Celsius Network (which had already been experiencing distress) also filed for Chapter 11 proceedings in New York. According to its court documents, Celsius’ distress was not directly linked to the default of Three Arrows or Voyager, or even the implosion of TerraUSD. Instead, these proceedings were a result of market participants being spooked by the decline in the market more generally. Celsius’ main business was based on customers transferring digital assets to the company and Celsius then lending those assets to third parties. Celsius paused withdrawals on its platform on June 12, 2022, and subsequently filed for bankruptcy in July.

FTX

In November, a portion of the Bahamas-based FTX Group filed for Chapter 11 proceedings in Delaware. Prior to the bankruptcy, CoinDesk reported a leak of a balance sheet related to the Alameda Research business showing that much of the $14.6bn of assets held by the business as of June 30 was the FTT token issued by FTX 1. Another crypto exchange, Binance, on November 6 announced plans to “liquidate any remaining FTT on our books” citing “recent revelations”2. A few days later, Binance abandoned a proposed distressed acquisition of FTX following due diligence into its operations and amid “news reports regarding mishandled customer funds and alleged U.S. agency investigations” according to a series of Tweets3.

On 11 November, 2022, the petition date, approximately $372mn of digital assets were stolen in an alleged hack and, separately, approximately $300mn of FTX Group’s FTT token was allegedly minted (the process by which tokens are created) without authorization. The declaration in support of the Chapter 11 proceedings shows that only $740mn of digital assets were located and secured, a fraction of the digital assets they hoped to recover, according to the First Day declaration4.

John J. Ray III, who oversaw Enron’s restructuring, replaced founder Samuel Bankman-Fried as CEO. “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here,” Ray stated in a declaration in support of the Chapter 11 proceedings5. On the evening of December 12, 2022, Bankman-Fried was arrested by Bahamian authorities following the U.S. Attorney for the Southern District of New York filing a sealed indictment that was shared with the Bahamian authorities. Bankman-Fried’s companies have reportedly extended loans to executives, according to FTX’s bankruptcy filings, with Alameda Research loaning $1bn to Bankman-Fried himself, $543mn to Head of Engineering, Nishad Singh, and $55mn to Ryan Salame, Co-Chief Executive of Bahamas-based FTX Digital Markets6. FTX also made loans to the digital asset lender BlockFi, which has subsequently declared bankruptcy, in order to help stabilize the business following the collapse of its counterparty, Three Arrows Capital.

Alongside the Chapter 11 proceedings in Delaware, a concurrent Chapter 15 case was filed in New York by Bahamian joint provisional liquidators for FTX Digital Markets, which is an entity regulated under the digital regulatory regime of the Bahamas. This case was subsequently transferred to Delaware. On November 10, the Securities Commission of the Bahamas suspended FTX Digital Markets' license to conduct business and froze its assets with a provisional liquidator appointed on the same day, according to the First Day Petition.

BlockFi

Following the losses BlockFi suffered from the collapse of Three Arrows Capital, BlockFi obtained a loan commitment from the FTX US business, which agreed to loan up to $400mn notional amount of digital assets to BlockFi7. As of November 28, 2022, the FTX US business had made loans under the commitment valued at $275mn according to a declaration in support of the Chapter 11 proceedings.

BlockFi filed for Chapter 11 protection on Nov. 29 in New Jersey, with the First Day Declaration saying the company was “faced with a severe liquidity crunch due to the unprecedented, expedited collapse” of FTX and affiliated companies and citing FTX as a “major cause” of the filing. The petition shows the company owes approximately $275mn in USD stablecoins to FTX and $30mn to the SEC8.

These bankruptcies are fast-moving and there is uncertainty about how they will play out. A number of key questions have emerged. Below, we focus here specifically on the most recent questions arising from the FTX bankruptcy:

These bankruptcies are fast-moving and there is uncertainty about how they will play out. A number of key questions have emerged. Below, we focus here specifically on the most recent questions arising from the FTX bankruptcy:

- How will the tussle between the U.S. debtors and Bahamas authorities play out amid allegations by FTX that the Caribbean authorities violated the Chapter 11 automatic stay when it seized FTX assets9, while the Securities Commission of the Bahamas called those statements “intemperate and inaccurate”10?

- FTX is facing a criminal probe in the Bahamas. To what extent can investors make claims against the founders and directors and officers. Will those recoveries be part of the estate and only available to the debtor?

- FTX’s new CEO has organized the enterprise into four separate silos, rather than by entity given alleged careless record-keeping. Given these allegations, how will the court allocate assets between those silos and various entities?

- What will recoveries look like for customers? Will customers need to make claims in the Bahamas as well as in the U.S.?

- What could the jurisdictional dispute in FTX mean for other cases and will other jurisdictions seek to assert authority?

- To what extent will court decisions on legal issues such as directors’ and officers’ liability, treatment of customer property, and independence of legal entities affect how EMs consider similar issues in the future?

- How will the lessons of that experience provide guidance to EM jurisdictions in how they develop frameworks for digital asset institutions?

How will the tussle between the U.S. debtors and Bahamas authorities play out amid allegations by FTX that the Caribbean authorities violated the Chapter 11 automatic stay when it seized FTX assets9, while the Securities Commission of the Bahamas called those statements “intemperate and inaccurate”10?

FTX is facing a criminal probe in the Bahamas. To what extent can investors make claims against the founders and directors and officers. Will those recoveries be part of the estate and only available to the debtor?

FTX’s new CEO has organized the enterprise into four separate silos, rather than by entity given alleged careless record-keeping. Given these allegations, how will the court allocate assets between those silos and various entities?

What will recoveries look like for customers? Will customers need to make claims in the Bahamas as well as in the U.S.?

What could the jurisdictional dispute in FTX mean for other cases and will other jurisdictions seek to assert authority?

To what extent will court decisions on legal issues such as directors’ and officers’ liability, treatment of customer property, and independence of legal entities affect how EMs consider similar issues in the future?

How will the lessons of that experience provide guidance to EM jurisdictions in how they develop frameworks for digital asset institutions?

The collapse of crypto firms will raise a number of questions that are likely to be explored in lengthy litigation proceedings, with relevance for customers, investors and regulators. The way in which these issues are dealt with can provide the insolvency framework for crypto firms in the future.

Sean A. O'Neal

Partner

New York

T: +1 212 225 2416

soneal@cgsh.com

V-Card

Ferdisha Snagg

Counsel

London

T: +44 20 7614 2251

fsnagg@cgsh.com

V-Card