Recent Developments:

Cross-Border Schemes

of Arrangement and Restructuring Plans

Schemes of arrangement under Part 26 of the Companies Act 2006 have long presented a favoured method for effecting cross-border restructurings. Similarly, foreign debtors have been quick to make use of the “cross-class cram down” provided by the Part 26A restructuring plan since its inception in 2020.

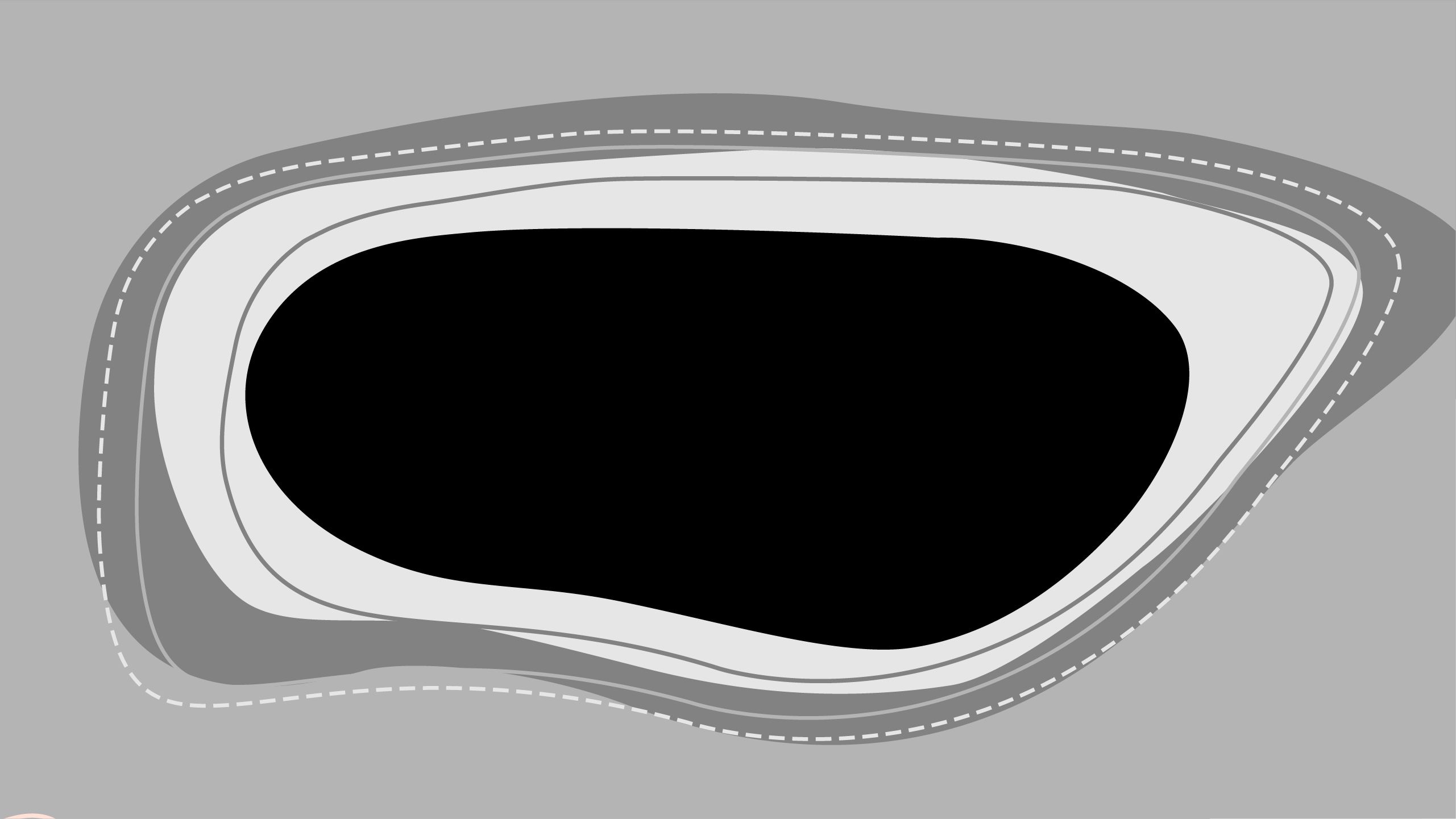

Both procedures offer speed, flexibility, and may enable amendments of debt contracts not available under the local law of a company’s jurisdiction of incorporation. Indeed, in the past year, almost 75% of schemes and plans have been filed by foreign entities1.

Recent case law suggests that English courts have no intention to withdraw their readiness to accept jurisdiction to consider and sanction schemes and plans for foreign companies, which is a key factor to their appeal. This article provides an overview of key developments in the English court’s consideration of cross-border schemes and plans in the past year and considers how such developments may affect England’s attractiveness as a restructuring venue.

Schemes of arrangement under Part 26 of the Companies Act 2006 have long presented a favoured method for effecting cross-border restructurings. Similarly, foreign debtors have been quick to make use of the “cross-class cram down” provided by the Part 26A restructuring plan since its inception in 2020.

Both procedures offer speed, flexibility, and may enable amendments of debt contracts not available under the local law of a company’s jurisdiction of incorporation. Indeed, in the past year, almost 75% of schemes and plans have been filed by foreign entities1.

Recent case law suggests that English courts have no intention to withdraw their readiness to accept jurisdiction to consider and sanction schemes and plans for foreign companies, which is a key factor to their appeal. This article provides an overview of key developments in the English court’s consideration of cross-border schemes and plans in the past year and considers how such developments may affect England’s attractiveness as a restructuring venue.

Jurisdiction and Recognition: gategroup and DTEK

There are well-established principles that guide the English court in its consideration of whether to sanction a scheme or plan2. Critically, additional questions are posed for foreign companies, in the case of a scheme or plan with international elements, namely:

- Whether there is a sufficient connection with England to justify the court exercising its jurisdiction to sanction the scheme or plan; and

- Whether the court will be acting in vain if it sanctions the scheme, which requires consideration of the effectiveness of the scheme or plan in relevant foreign jurisdictions3.

The scope of both requirements has been further clarified by the English court this year.

Forum Shopping and Sufficient Connection: Re gategroup Guarantee Limited

For the English court to exercise its jurisdiction to sanction a scheme or plan, it must be satisfied that there is a sufficient connection with England. In cases where the liabilities to be compromised under the scheme or plan are governed by English law, this requirement is generally met. Other relevant factors that will aid the establishment of a sufficient connection include whether the scheme or plan company has its centre of main interests (“COMI”) in England and an establishment or substantial assets in England.

The attractions of the English court as a venue for foreign companies seeking to enforce their cross-border restructurings has led to the trend of “forum shopping” by foreign companies with no apparent connection with England prior to the restructuring process. In this process, certain arrangements such as a co-obligor structure are put in place as an avenue to satisfy the sufficient connection test4.

As the largest international airline catering services provider, the gategroup group’s business declined dramatically after a significant reduction of flights and passenger numbers in wake of the COVID-19 pandemic.

In Re gategroup Guarantee Limited, the plan company was incorporated in the U.K. as a wholly owned subsidiary of gategroup Holding AG, a company incorporated in Switzerland. The plan company’s COMI was also established in the U.K.

To create a subrogation claim, gategroup Guarantee Limited agreed, by way of deed poll, to indemnify and make a payment by way of contribution up to the full amount of the liabilities of two different subsidiaries of the parent: gategroup Financial Services S.à.r.l., with obligations under a senior facilities agreement; and gategroup Finance SA, the issuer of bonds governed by Swiss law and containing an exclusive jurisdiction clause in favour of the courts of Zurich. Subsequently, under a separate “Contribution Payment Agreement”, the two separate subsidiaries agreed to fund any payments required by gategroup Guarantee Limited under the deed poll.

In his convening order, Zacaroli J emphasised that the co-obligor structure could be “wholly objectionable” if it “overrode legitimate interests of creditors” pursuant to contracts governed by foreign law and conflicted with foreign jurisdictions’ principles of insolvency law5. However, the court found in favour of a sufficient connection – as the plan company had considered all possible alternatives, and none were realistically available, and the structure was in the interests of creditors in comparison to the alternative of liquidation. The case should provide reassurance on the ability of such a structure to effect third party releases as part of a plan6.

A Modest Standard: Re DTEK Energy BV

In relation to the English court’s consideration of whether the scheme or plan will be recognised and given effect in relevant foreign jurisdictions, Re DTEK Energy BV7 more recently confirmed the standard that must be met to satisfy the English court that sanctioning a scheme or plan would not be an act in vain. The DTEK group operates as an integrated energy supplier primarily in Ukraine in sectors including coal, thermal electricity, and energy services provision. The parent company, DTEK Energy BV, is incorporated in the Netherlands. Following the pandemic, the group struggled to minimise the effects of the economic downturn and systemic crisis in the Ukrainian energy market.

Most significantly, Gazprombank argued that the English court cannot be satisfied as to the international effectiveness of the scheme and to sanction the scheme would be an act in vain.

Gazprombank’s argument primarily relied on the impact of the Judgments Regulation8 no longer applying post-Brexit. Gazprombank submitted that prior to Brexit, English schemes were generally considered to be effective because of the Judgments Regulation9.

Sir Alastair Norris rejected Gazprombank’s argument that there was a vacuum left by the Judgments Regulation and that the court is now in “entirely novel territory”, noting that there had always been uncertainty as to how schemes fit into the regulation’s framework. Even before Brexit, the Judgments Regulation had not been regarded as sufficient in itself to prove international effectiveness. Instead, the English courts often looked to expert evidence to demonstrate alternative grounds.

The court was asked to consider the effectiveness of the bank scheme as a matter of Dutch law and was presented two opposing expert opinions for this purpose. Reiterating that the English court cannot decide between two rival views on foreign law, Sir Alastair Norris held that the expert evidence supporting the bank scheme’s likely recognition in the Netherlands could not be dismissed, as it was:

- Credible;

- Founded on a coherent construction of Rome I;10

- Consistent with other evidence previously relied on by the English court; and

- In accordance with generally accepted principles of private international law, including the principle that the variation or discharge of a contractual right in accordance with the governing law of the contract will generally be given effect in other countries.

The “modest standard” of a scheme having a reasonable prospect of having substantial effect was satisfied.

The judgment confirms the significance the English court will place on the application of private international law in the relevant foreign jurisdiction, and clarifies that recognition of a scheme or plan in the relevant foreign jurisdiction need not be certain. For many emerging markets debtors, private international law will most likely be the primary standard for determining effectiveness, as many emerging markets jurisdictions lack legal bases for the automatic recognition of English judgments11.

Moreover, it was deemed significant that 95% of bank scheme creditors approved the scheme, beyond the requisite statutory majority. This very solid scheme creditor support aided the court in regarding the scheme as substantially effective12.

Limits to restructuring plans: Hurricane Energy

For the first time since the inception of the plan process in June 2020, the English court declined to sanction a plan in June 202113. The Hurricane Energy group’s business comprises oil discovery and development. During 2021, although Hurricane Energy PLC was still making interest payments under its bonds maturing on 24 July 2022, it predicted that it would be unable to repay the bonds in full on maturity. The plan was therefore initiated, involving an extension of the maturity date of the bonds, a reduction in the capital amount due and an increase in the coupon, among other elements.

The uncertainty surrounding the proposed relevant alternative was fatal for the plan’s sanction; the court was not satisfied that plan company would not be able to discharge its obligations to the bondholders, and refuted their contention that the class of shareholders, who under the plan would have seen a drastic dilution of their holdings by 95%, would be no better off under the relevant alternative than under the plan.

Companies seeking to restructure debt via a plan when they are not necessarily facing a clear alternative of insolvency may wish to be wary of the expected scrutiny of their relevant alternative14.

Conclusion

Recent case law has confirmed the availability of certain avenues in establishing a sufficient connection with England for the court to exercise its jurisdiction and sanction a scheme. Since Brexit, the English Court has reaffirmed the flexibility of schemes and plans as restructuring tools, giving further clarity regarding tests of jurisdiction and in particular concepts such as the ‘relevant alternative’ introduced by the Part 26A process.