As the Russia-Ukraine war continues, international capital markets investors face greater uncertainty and complexities when considering investment opportunities in the region. Amidst these challenges, it is imperative for investors to carefully navigate various factors when investing in Ukrainian companies.

In this article, we discuss the five key practical questions that investors should bear in mind when exploring investment opportunities in the region.

The National Bank of Ukraine (NBU) has implemented a series of capital controls and exchange restrictions aimed at safeguarding the nation’s economy and ensuring financial stability during martial law. There is a general prohibition on cross-border foreign currency payments without permission from the NBU which is, however, subject to a number of exceptions including transfers of funds abroad:

By Ukrainian borrowers to meet their foreign loan obligations where such loans are (i) guaranteed by an international financial institution or (ii) granted with the participation of a foreign export credit agency, a foreign state, or through a foreign entity whose shareholders include a foreign state or a foreign state bank, such as through the provision of liquidity, insurance, or guarantees; and

To pay interest (up to a maximum interest rate of 12%) and repay principal on international debt issued after June 20, 2023.

By Ukrainian borrowers to meet their foreign loan obligations where such loans are (i) guaranteed by an international financial institution or (ii) granted with the participation of a foreign export credit agency, a foreign state, or through a foreign entity whose shareholders include a foreign state or a foreign state bank, such as through the provision of liquidity, insurance, or guarantees; and

To pay interest (up to a maximum interest rate of 12%) and repay principal on international debt issued after June 20, 2023.

In addition, provided that Ukrainian borrowers do not use the proceeds of borrowings obtained within Ukraine for this purpose, they are permitted to:

- pay up to €1mn of interest quarterly under each individual debt instrument entered into prior to June 20, 2023 in respect of overdue interest accrued during the period from February 24, 2022 to April 30, 2024;

- pay interest due after April 30, 2024 as it falls due (no cap); and

- to pay up to €1mn in dividends per month (in respect of dividends accrued from January 1, 2024 onwards only); and

- pay dividends abroad in amounts sufficient to reimburse coupon payments to be made under Eurobonds between February 24, 2022 and July 9, 2024, provided that the relevant payor is a surety (guarantor) for such Eurobonds and complies with all other requirements imposed by its servicing bank.

Recently, the NBU has permitted Ukrainian sureties (guarantors) to make dividend payments abroad to service coupon payments on Eurobonds issued by their foreign affiliates. This exception does not impose monthly caps or limits based on the reference year. Instead, it permits dividend payments for any year, in amounts sufficient to cover scheduled coupon payments due after July 10, 2024, in accordance with the terms of the relevant Eurobonds.

The European Union (EU), UK and the U.S., amongst others, have all imposed various sanctions against individuals and companies with connections to Russia. Sanctions and the ongoing conflict continue to significantly disrupt exports from the region for commodities, pushing up inflation. This has had a negative impact on the economy and investments in Ukraine.

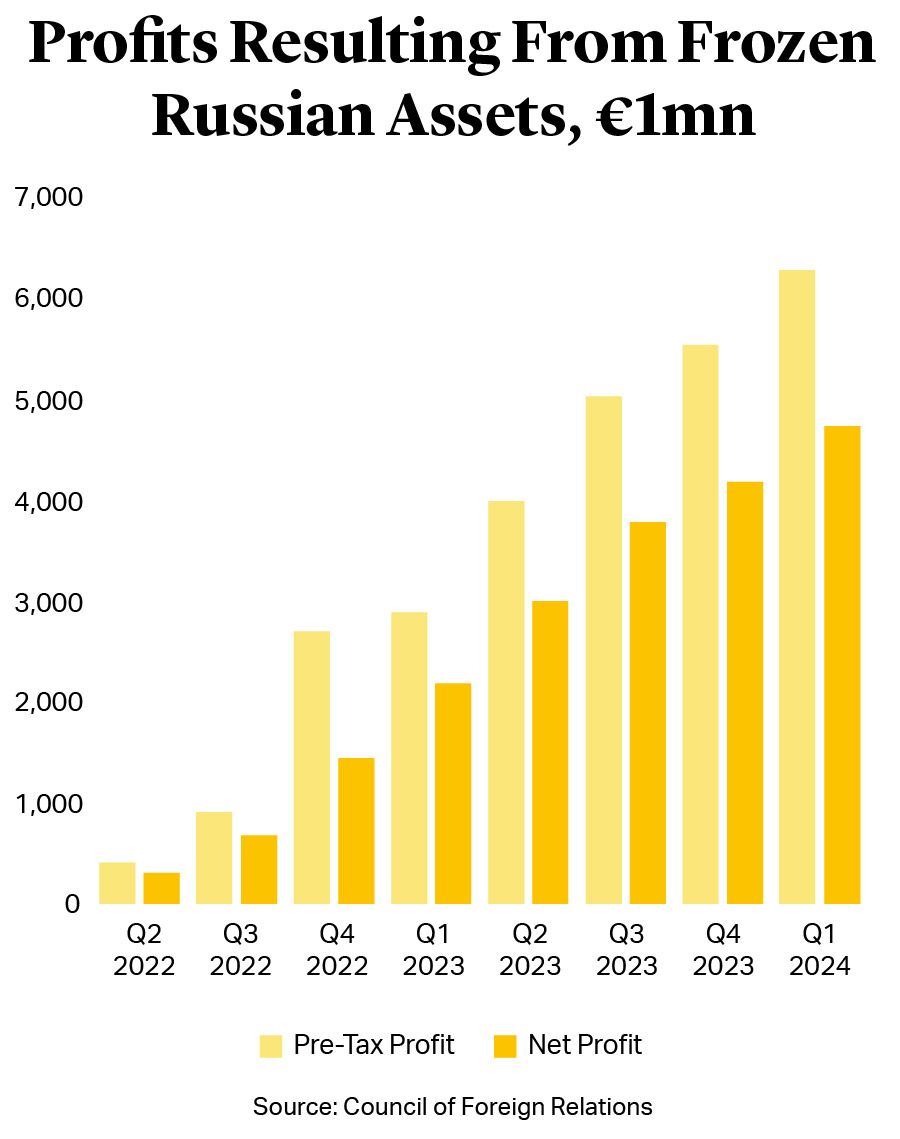

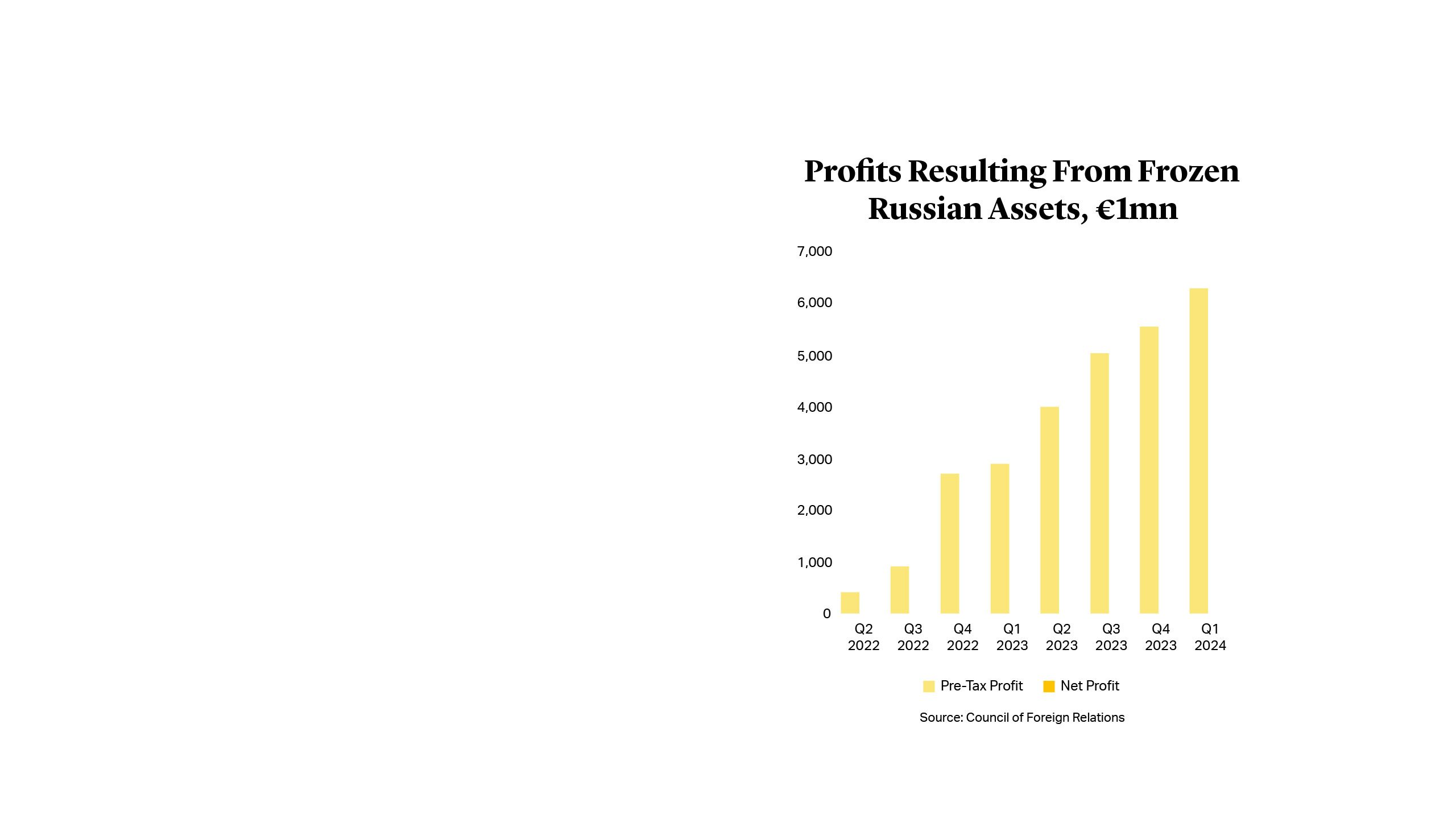

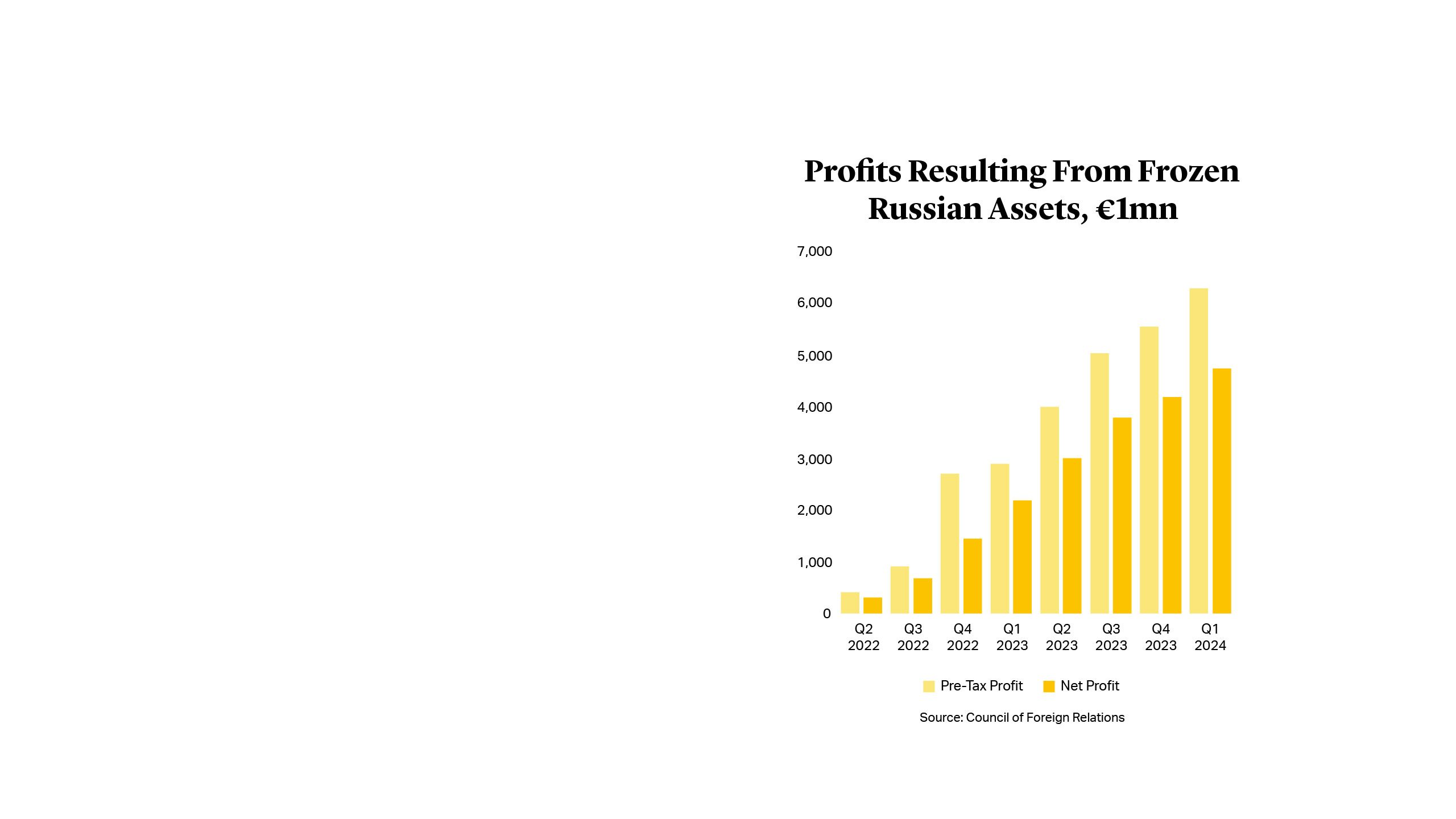

In addition, since Russia’s invasion of Ukraine, hundreds of billions of dollars in assets have been frozen as part of international sanctions. In May 2024, the EU announced plans to use profits from these frozen Russian sovereign assets to provide critical financial support to Ukraine amidst the ongoing war, as well as its extensive humanitarian and reconstruction needs. Specifically, the EU intends to allocate up to $3.25bn from the profits generated by these frozen assets to fund Ukraine’s military and defense infrastructure.

Further, sanctions make it difficult or illegal for payments to be made to bondholders (for example, where payments are to be made via sanctioned custodians, such as the Russian National Securities Depository (NSD)), without a license. As a result, without a license, the clearing systems are unable to make payments to sanctioned custodians, such as the NSD. Consequently, funds paid by issuers to bondholders through the clearing systems are being held within the clearing systems.

In addition, in the context of a restructuring, sanctions-related restrictions create significant complications, as obtaining specific licenses may cause delays and uncertainty.

The European Union (EU), UK and the U.S., amongst others, have all imposed various sanctions against individuals and companies with connections to Russia. Sanctions and the ongoing conflict continue to significantly disrupt exports from the region for commodities, pushing up inflation. This has had a negative impact on the economy and investments in Ukraine.

In addition, since Russia’s invasion of Ukraine, hundreds of billions of dollars in assets have been frozen as part of international sanctions. In May 2024, the EU announced plans to use profits from these frozen Russian sovereign assets to provide critical financial support to Ukraine amidst the ongoing war, as well as its extensive humanitarian and reconstruction needs. Specifically, the EU intends to allocate up to $3.25bn from the profits generated by these frozen assets to fund Ukraine’s military and defense infrastructure.

Further, sanctions make it difficult or illegal for payments to be made to bondholders (for example, where payments are to be made via sanctioned custodians, such as the Russian National Securities Depository (NSD)), without a license. As a result, without a license, the clearing systems are unable to make payments to sanctioned custodians, such as the NSD. Consequently, funds paid by issuers to bondholders through the clearing systems are being held within the clearing systems.

In addition, in the context of a restructuring, sanctions-related restrictions create significant complications, as obtaining specific licenses may cause delays and uncertainty.

It is practically possible to enforce in Ukraine if there is a default. However, there are a number of issues that make enforcing in Ukraine particularly challenging in the event of borrower default:

Enforcing Over Pledged Assets: Enforcing security over pledged assets can pose significant challenges when there is no viable market for the sale of those types of assets. Additionally, the prospects of such a sale may be affected by various pre-emptive rights of third parties that attach to certain types of assets. Before enforcement, creditors should assess the value of any assets and the ability to sell those assets, as this will inform their strategy.

Enforcement Proceeds: Converting and transferring funds abroad obtained from enforcing security can be difficult and requires cooperation from various stakeholders. This process may be costly and time consuming for investors.

Delaying Tactics: Enforcing in Ukraine can be challenging due to legal loopholes and certain practices that allow borrowers to delay repayment including, for example, borrowers initiating bankruptcy proceedings, and inefficiencies in the judicial system. For these reasons, investors often elect to work collaboratively with the debtor to implement a restructuring or liability management exercise.

Foreign Currency and Cross-Border Payments Under Guarantees: The NBU regulates the purchase of foreign currency and generally restricts cross-border foreign currency payments. If an entity needs to make a payment under a suretyship (guarantee) in a foreign currency, they must first obtain the necessary amount of that currency. The NBU’s regulations may make it difficult for entities to gather the required funds quickly and efficiently. In addition, payments under the suretyships covering obligations of non-Ukrainian obligors are not currently permitted by the NBU. As an exception, the NBU has only permitted payments under the suretyships relating to eligible new money loans raised by Ukrainian borrowers.

Cross-Border Payments Pursuant to Foreign Judgements and Arbitral Awards: It remains uncertain whether payments under foreign judgements or arbitral awards obtained abroad are permitted in light of the NBU’s martial law restrictions.

Registration and Renewal of Security: Security interests must be registered in the appropriate public register to ensure priority against third parties and recognition in the grantor’s insolvency. Registration of pledges over movable property is valid for five years. To extend this period, lenders must renew the security before the term expires. Failure to renew does not terminate the pledge but causes the registration to lapse, affecting the lender’s priority against other registered pledgees or a liquidator. In such case, the pledge may not be enforceable against a bona fide purchaser of the pledged assets unaware of the pledge.

Amidst the challenges posed by capital controls put in place by the NBU discussed in the first question, IFIs have played a vital role in providing financing to Ukrainian companies, enabling them to continue operations and meet international debt obligations. In particular, IFIs provide crucial financial support for projects, creating more investment opportunities for investors. Further, they offer blended finance opportunities, allowing private investors to share the risk with IFIs investing in the region.

In addition, IFIs have also played a key role in influencing the relaxation of exchange restrictions, which in turn is beneficial for debt capital market investors. For example, as part of the funding facility provided to Ukraine by the International Monetary Fund (IMF) in April 2023, Ukraine committed to gradually lift the capital controls put in place by February 2024. Subsequently, in May 2023, the NBU provided a roadmap for lifting certain restrictions on foreign exchange transfers. Since then, the NBU has taken steps to lift certain restrictions.

Amidst the challenges posed by capital controls put in place by the NBU discussed in the first question, IFIs have played a vital role in providing financing to Ukrainian companies, enabling them to continue operations and meet international debt obligations. In particular, IFIs provide crucial financial support for projects, creating more investment opportunities for investors. Further, they offer blended finance opportunities, allowing private investors to share the risk with IFIs investing in the region.

In addition, IFIs have also played a key role in influencing the relaxation of exchange restrictions, which in turn is beneficial for debt capital market investors. For example, as part of the funding facility provided to Ukraine by the International Monetary Fund (IMF) in April 2023, Ukraine committed to gradually lift the capital controls put in place by February 2024. Subsequently, in May 2023, the NBU provided a roadmap for lifting certain restrictions on foreign exchange transfers. Since then, the NBU has taken steps to lift certain restrictions.

However, the involvement of IFIs can complicate restructuring negotiations. The terms and conditions of any debt facility advanced by an IFI may significantly constrain possible amendments to bond or bank debt as they often include a number of restrictions to ensure that their interests are adequately protected and the funding advanced is used for very specific purposes.

However, the involvement of IFIs can complicate restructuring negotiations. The terms and conditions of any debt facility advanced by an IFI may significantly constrain possible amendments to bond or bank debt as they often include a number of restrictions to ensure that their interests are adequately protected and the funding advanced is used for very specific purposes.

The Ukrainian sovereign and many Ukrainian companies have agreed standstill arrangements with their creditors to provide them with the necessary breathing room following Russia’s invasion of Ukraine. These agreements typically defer interest and principal payments for a specified period, allowing the debtor time to stabilize their financial situation and preserve value without the immediate pressure of repayment or threat of default. During the standstill, creditors have the time to assess the situation and continue to engage with the debtor to reach a more holistic solution, where necessary.

By way of example, in December 2022, Ukrainian Railways announced that it had agreed with bondholders to extend the maturity on its Eurobonds and postpone payment of the coupon, however interest will continue to accrue during the deferral period. Following the end of the deferral period, the coupon would either be paid in cash or capitalized.

In August 2022, Ukraine’s creditors agreed to a two-year standstill on approximately $20bn of Eurobond debt, deferring interest payments until August 2024. On August 28, 2024, Ukraine announced the successful restructuring of its outstanding sovereign and guaranteed Eurobonds, totaling $20.47bn. This restructuring was carried out through an exchange offer and consent solicitation, which received approval from 97.38% of the bondholders. Notably, Eurobonds issued by the State Agency for Restoration and Development of Infrastructure (formerly Ukravtodor) which were guaranteed by Ukraine were included in the sovereign debt restructuring, as these bonds had aggregation provisions allowing them to be “wrapped” into the sovereign restructuring or consent solicitation. It is important that investors carefully check for these types of provisions when considering investing in state-owned enterprises.

By way of example, in December 2022, Ukrainian Railways announced that it had agreed with bondholders to extend the maturity on its Eurobonds and postpone payment of the coupon, however interest will continue to accrue during the deferral period. Following the end of the deferral period, the coupon would either be paid in cash or capitalized.

In August 2022, Ukraine’s creditors agreed to a two-year standstill on approximately $20bn of Eurobond debt, deferring interest payments until August 2024. On August 28, 2024, Ukraine announced the successful restructuring of its outstanding sovereign and guaranteed Eurobonds, totaling $20.47bn. This restructuring was carried out through an exchange offer and consent solicitation, which received approval from 97.38% of the bondholders. Notably, Eurobonds issued by the State Agency for Restoration and Development of Infrastructure (formerly Ukravtodor) which were guaranteed by Ukraine were included in the sovereign debt restructuring, as these bonds had aggregation provisions allowing them to be “wrapped” into the sovereign restructuring or consent solicitation. It is important that investors carefully check for these types of provisions when considering investing in state-owned enterprises.