Sovereign debt sits at the intersection of politics, finance, law, and economics. Unique in their power dynamics and lack of institutionalized process, sovereign debt restructurings are a looming crisis, in the wake of COVID-19, as the International Monetary Fund (IMF) predicts an “unprecedented jump” in 2020 sovereign debt levels.

Sovereign debt sits at the intersection of politics, finance, law, and economics. Unique in their power dynamics and lack of institutionalized process, sovereign debt restructurings are a looming crisis, in the wake of COVID-19, as the International Monetary Fund (IMF) predicts an “unprecedented jump” in 2020 sovereign debt levels.

So, What Is Being Done?

Collective Action Clauses (CACs)

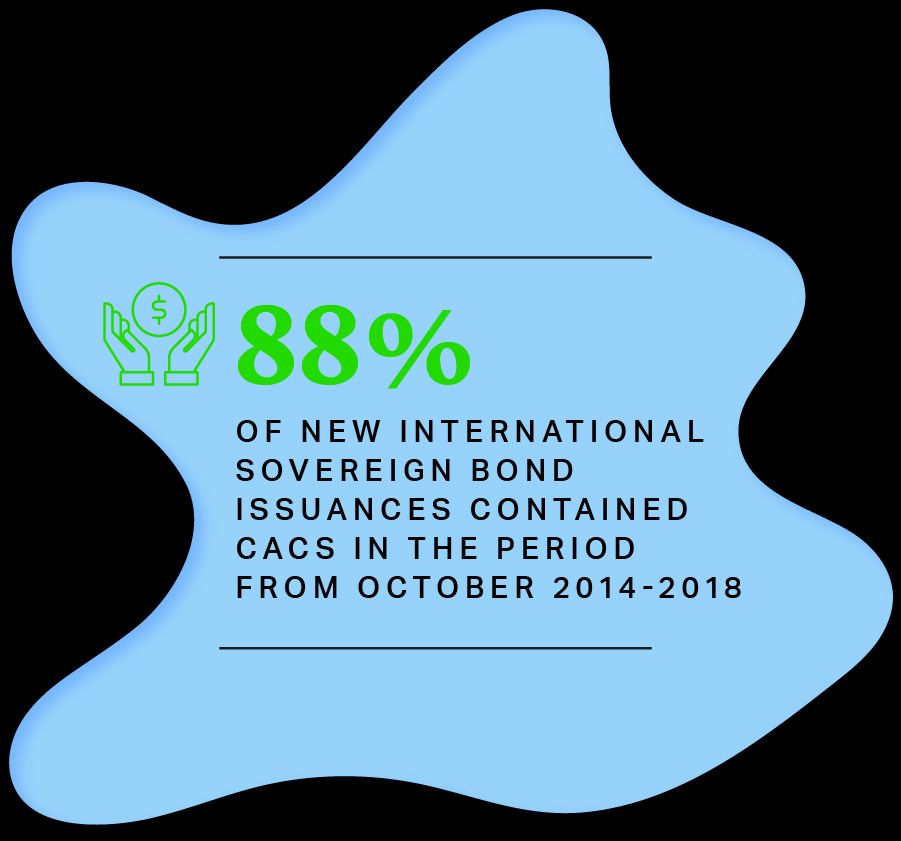

CACs pre-bind all bondholders to restructuring terms when they are approved by a specified bondholders’ supermajority. They are currently viewed as sovereigns’ best available tool to pre-empt restructuring and minimize economic disruption.

According to the IMF, 88% of new international sovereign bond issuances contained CACs in the period from October 2014-2018.

“Extendable Debt” Clauses

There is growing support for sovereign debt clauses that automatically suspend or lower principal and interest payments, following economic shock. Natural disaster clauses give us an idea of how this would work.

So, What Is Being Done?

Collective Action Clauses (CACs)

CACs pre-bind all bondholders to restructuring terms when they are approved by a specified bondholders’ supermajority. They are currently viewed as sovereigns’ best available tool to pre-empt restructuring and minimize economic disruption.

According to the IMF, 88% of new international sovereign bond issuances contained CACs in the period from October 2014-2018.

“Extendable Debt” Clauses

There is growing support for sovereign debt clauses that automatically suspend or lower principal and interest payments, following economic shock. Natural disaster clauses give us an idea of how this would work.

The Natural Disaster Clause: An Overview

This clause allows sovereigns to defer debt payments following a qualifying natural disaster to mitigate financial damage. Climate change is intensifying natural disasters’ frequency and impact. Hurricanes, for example, can cause billions of dollars in damage; they also disproportionately impact smaller countries, for example islands in the Caribbean.

Natural disaster clauses offer sovereigns immediate relief and ongoing financial support. They also benefit creditors, who avoid the repercussions of costly formal restructuring or disorderly default.

The Natural Disaster Clause: An Overview

This clause allows sovereigns to defer debt payments following a qualifying natural disaster to mitigate financial damage. Climate change is intensifying natural disasters’ frequency and impact. Hurricanes, for example, can cause billions of dollars in damage; they also disproportionately impact smaller countries, for example islands in the Caribbean.

Natural disaster clauses offer sovereigns immediate relief and ongoing financial support. They also benefit creditors, who avoid the repercussions of costly formal restructuring or disorderly default.

A Closer Look at Natural Disaster Clauses

The first natural disaster clause appeared in Grenada’s 2015 debt restructuring. The clause is triggered where a tropical cyclone causes $15 million to $30 million in losses.

With up to $700 million (almost 15% of its economy) now available for natural disaster recovery, Barbados is considered the world’s only sovereign with a climate-resilient public debt stock.

Putting the Natural Disaster Clause in Context: Other Applications

Pandemic clauses – a variation on natural disaster clauses, still in embryo – could be the answer to COVID-19 and future health crises. Pandemic Emergency Financing (PEF) Bonds (an International Bank for Reconstruction and Development (IBRD) and World Health Organization (WHO) joint venture) are a useful point of comparison for how these clauses would work.

Conclusion

Scientists have found that lizards are evolving to survive hurricanes, by growing longer limbs and stronger claws to cling on. As climate change forces Caribbean islands to evolve, Grenada and Barbados’ longer limbs and stronger claws are an inspiration for other small developing nations, vulnerable to natural disasters. Perhaps it should also inspire greater sovereign debt innovation, to tackle crises like COVID-19.

Jim Ho

Partner

London

T: +44 20 7614 2284

jho@cgsh.com

V-Card

Stephanie Fontana

Associate

New York

T: +1 212 225 2506

stfontana@cgsh.com

V-Card