Private Equity

Market Snapshot

November 2021

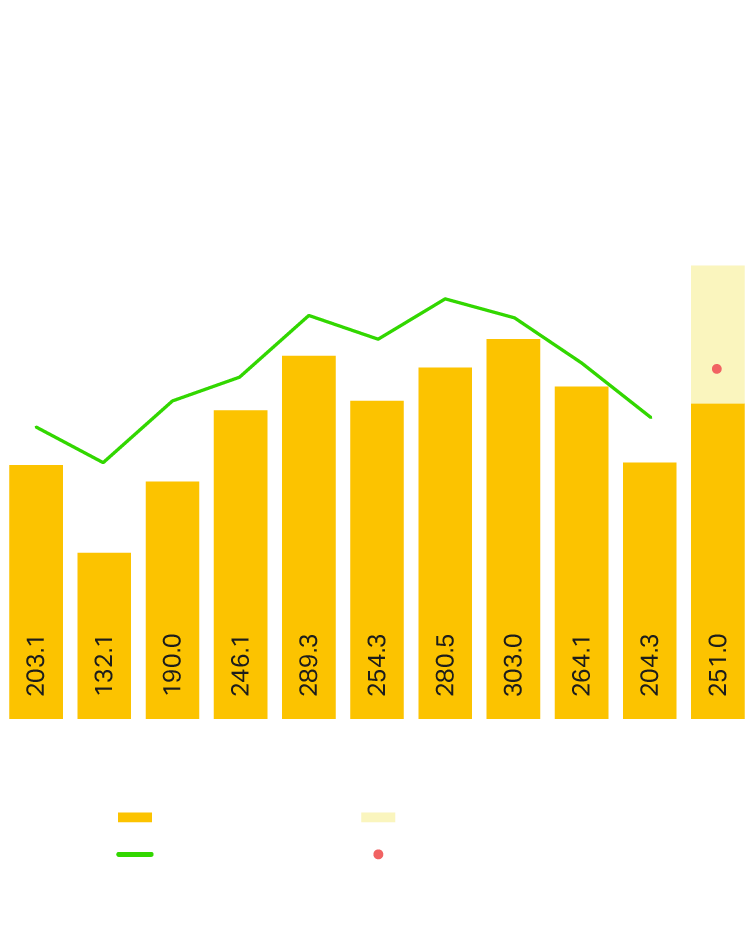

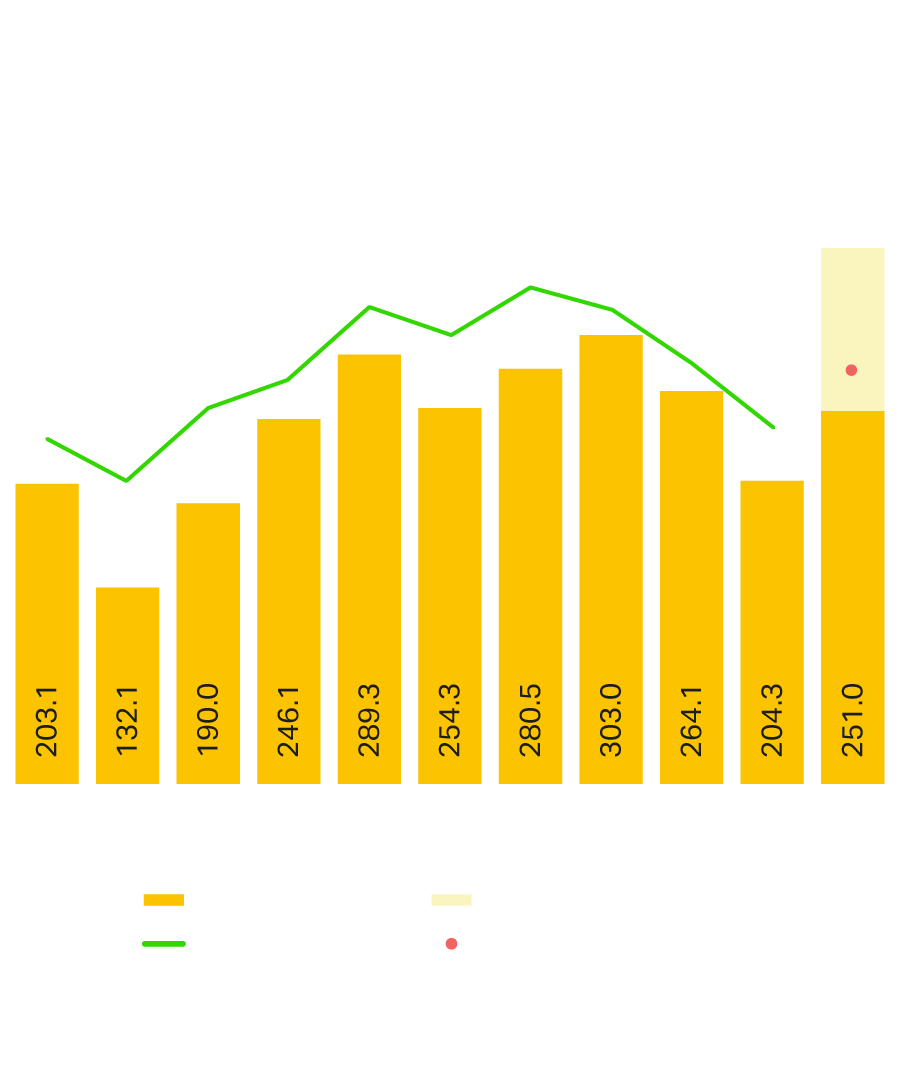

With just a few weeks of the year still remaining, private equity deal activity in Europe has already hit new records. By the end of the third quarter, private equity firms had agreed almost 5,500 deals worth nearly €550bn, according to Pitchbook data, well ahead of the previous peak of €493bn invested in 2018. To put that volume of investment into context, the three largest-ever quarters for private equity deal activity have all been in 2021.

European Exits Hit New Records

Confidence in the recovery from the effects of COVID-19, combined with large reserves of capital among investors and cheap financing conditions, have also continued to fuel exits. Private equity closed 425 exits worth some €126bn in the third quarter, representing growth of 96% and over 200% year-on-year respectively, Pitchbook data shows.

Not only have there been more divestments, but also more large divestments as sponsors have taken advantage of buoyant markets to exit some of their flagship holdings. Among those, the completion of Hellman & Friedman’s merger of its Danish payments business Nets with Italy’s Nexi in a €7.6bn share deal at the start of July, marked one of the largest deals of the third quarter.

That appetite has continued strongly into the final months of the year. In October, EQT sold Switzerland-headquartered VFS Global, the largest provider of visa outsourcing services, to Blackstone for $2.5bn. And in early November, UK-based Inmarsat agreed a $7.3bn cash and shares deal with Viasat, a U.S. satellite and communications peer, just two years after it was taken private by an Apax and Warburg Pincus-led consortium1.

European Exits Hit New Records

Confidence in the recovery from the effects of COVID-19, combined with large reserves of capital among investors and cheap financing conditions, have also continued to fuel exits. Private equity closed 425 exits worth some €126bn in the third quarter, representing growth of 96% and over 200% year-on-year respectively, Pitchbook data shows.

Not only have there been more divestments, but also more large divestments as sponsors have taken advantage of buoyant markets to exit some of their flagship holdings. Among those, the completion of Hellman & Friedman’s merger of its Danish payments business Nets with Italy’s Nexi in a €7.6bn share deal at the start of July, marked one of the largest deals of the third quarter.

That appetite has continued strongly into the final months of the year. In October, EQT sold Switzerland-headquartered VFS Global, the largest provider of visa outsourcing services, to Blackstone for $2.5bn. And in early November, UK-based Inmarsat agreed a $7.3bn cash and shares deal with Viasat, a U.S. satellite and communications peer, just two years after it was taken private by an Apax and Warburg Pincus-led consortium1.

Capacity to Complete Reaches Saturation Point

The final quarter frequently marks the high point for annual M&A activity as sponsors and investment banks race to complete deals before year-end. While appetite to deploy capital, arrange deals and provide financing packages clearly remains strong, some of the impetus to finalise deals may be reduced as investment and advisory targets have already been met or exceeded in many cases.

There are also indications that capacity has been reached elsewhere in the system. Insurers providing warranty & indemnity insurance to prospective private equity buyers now have such a pipeline that the last window to secure insurance before year-end may already have closed.

There are signs of a slight cooling elsewhere in private equity. European fundraising could meet prior records at around €100bn in 2021, but a deceleration from the strong first half means that the number of funds raising capital could be its lowest since 2012, according to Pitchbook.

Climate Tech in the Spotlight as Nations Gather for COP26

COP26 brought governments, businesses and investors together in Glasgow to discuss climate change and the actions needed to meet net zero. While nations agreed a Climate Pact that will see 197 countries around the world report their progress on climate ambition next year, business bodies were among those expressing disappointment that policymakers had not gone further2.

Across Europe, almost one-third of the largest listed companies have committed to reach net zero by 2050, according to Accenture3. Momentum is also gathering within the private equity industry. Europe trade association Invest Europe recently made its own Climate Ambition Statement to take the necessary measures to reach net zero as an organisation by 2030. The association outlined the steps it would take to help the European private equity industry address climate change and become more sustainable4.

We have seen private equity firms put ESG and climate considerations more firmly into investment processes. Increasingly, sponsors’ dedicated ESG teams are involved in transactions at the due diligence stage in order to monitor environmental, social or governance risks at target companies. As a result, investment committees are also weighing ESG issues as a matter of course.

While climate and ESG more broadly create challenges for sponsors, new norms are also creating opportunities. According to research from Dealroom and London & Partners, climate tech companies have raised $32bn in 2021 – almost five times more than five years ago in 2016. Of that, $4.3bn was invested in climate tech companies in the UK, with Europe the fastest-growing region for investment5.

Michael J. Preston

Partner

London

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

Gabriele Antonazzo

Partner

London

T: +44 20 7614 2353

gantonazzo@cgsh.com

V-Card

Michael James

Partner

United Kingdom

Michael J. Preston

Partner

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

David J. Billington

Partner

T: +44 20 7614 2263

dbillington@cgsh.com

V-Card

Gabriele Antonazzo

Partner

T: +44 20 7614 2353

gantonazzo@cgsh.com

V-Card

Nallini Puri

Partner

T: +44 207 6142289

npuri@cgsh.com

V-Card

Michael James

Partner

T: +44 20 7614 2219

mjames@cgsh.com

V-Card

Lawale Ladapo

Associate

France

Amélie Champsaur

Partner

T: +33 1 40 74 68 00

achampsaur@cgsh.com

V-Card

Charles Masson

Partner

Germany

Michael J. Ulmer

Partner

T: +49 69 97103 180

mulmer@cgsh.com

V-Card

Mirko von Bieberstein

Senior Attorney

Italy

Roberto Bonsignore

Partner

T: +39 02 7260 8230

rbonsignore@cgsh.com

V-Card

Carlo de Vito Piscicelli

Partner

T: +44 20 7614 2257

cpiscicelli@cgsh.com

V-Card

David Singer

Associate